Introduction

In the realm of international travel and business, managing foreign currency can be a cumbersome and often confusing task. Exchange rates fluctuate constantly, and navigating the complexities of different currencies can prove daunting. Fortunately, Standard Chartered Bank has introduced its Forex Card, a revolutionary solution that simplifies global currency management for individuals and businesses alike.

Image: techjaja.com

Standard Chartered Bank’s Forex Card is seamlessly integrated with your existing Standard Chartered bank account, enabling you to enjoy the convenience of carrying multiple currencies on a single card. Whether you’re a frequent traveler, an international entrepreneur, or simply need to make occasional cross-border transactions, the Standard Chartered Bank Forex Card empowers you with the flexibility and security to navigate the global financial landscape with ease.

Understanding the Benefits of a Forex Card

The Standard Chartered Bank Forex Card offers a myriad of advantages that make it an indispensable tool for global citizens.

Convenience and Flexibility:

The Forex Card eliminates the hassle of carrying large amounts of foreign currency and eliminates the associated risks of theft or loss. With the Forex Card, you can easily switch between currencies at the most favorable rates, saving time and money.

Competitive Exchange Rates:

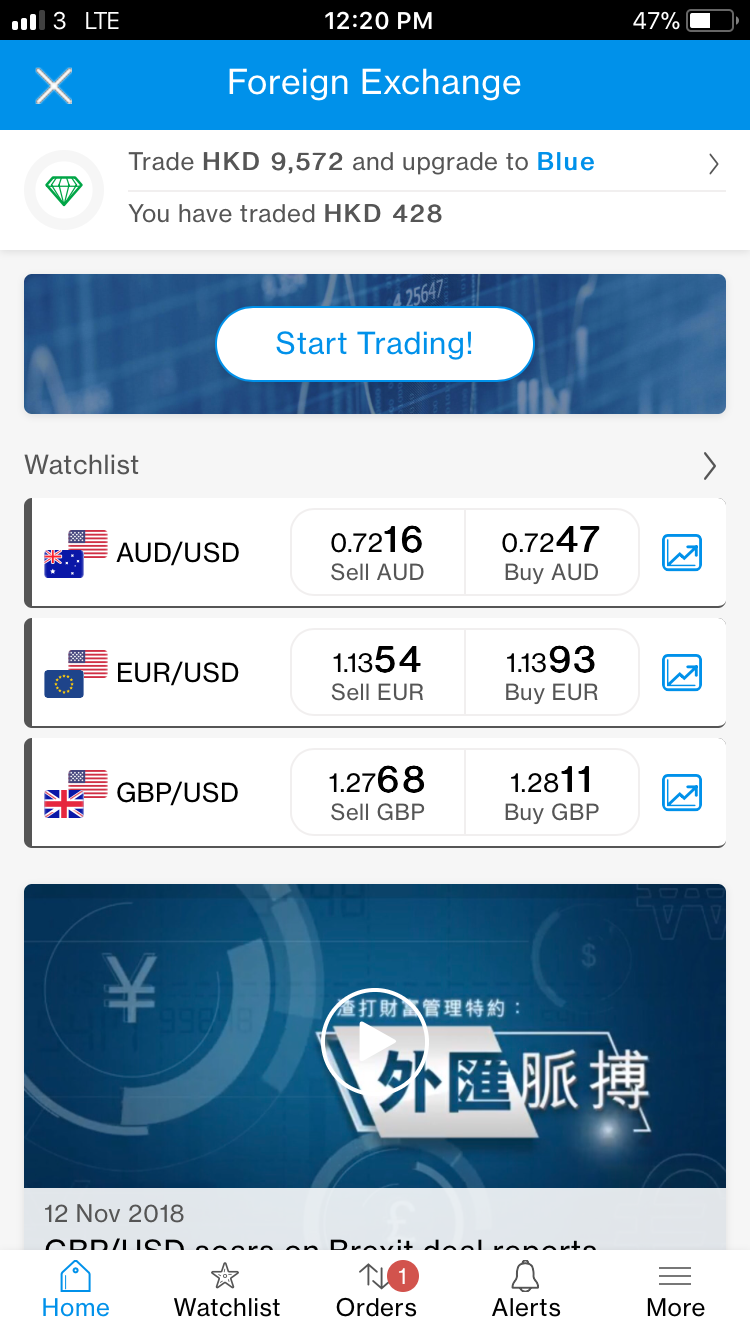

Standard Chartered Bank offers competitive exchange rates, ensuring that you get the most value for your money. The Forex Card automatically updates exchange rates in real-time, providing you with the most accurate rates available.

Image: 5emasforextradingsystemfreedownload.blogspot.com

Multiple Currency Management:

The Standard Chartered Bank Forex Card allows you to load multiple currencies onto a single card, providing you with the flexibility to manage your finances in different countries without the need for multiple cards or accounts.

Security and Peace of Mind:

The Forex Card is protected by robust security measures, including chip and pin technology and transaction authorization via SMS or mobile banking app. In case of loss or theft, the card can be blocked instantly, safeguarding your funds.

Wide Global Acceptance:

Standard Chartered Bank’s Forex Card is widely accepted at millions of ATMs, POS terminals, and online merchants worldwide, giving you access to your funds conveniently wherever you are.

Features and Functionality of the Forex Card

The Standard Chartered Bank Forex Card is designed with a host of features and functionalities to cater to the needs of discerning global travelers and businesspeople.

Prepaid Convenience:

Load the Forex Card with the desired amount of foreign currency before your trip or business meeting. This prepaid feature eliminates the need to carry large amounts of cash or worry about exchange rates.

Real-Time Currency Conversion:

The Forex Card automatically converts the payment amount to the local currency at the most favorable exchange rate at the time of transaction.

Transaction Tracking:

Keep track of your spending with ease through the Standard Chartered mobile banking app or online banking portal. Transaction details, including currency exchange rates, are readily available for your reference.

Reload and Top-Up:

Reload the Forex Card with additional funds as needed to ensure uninterrupted access to your funds. Conveniently reload through online banking, mobile app, or at any Standard Chartered Bank branch.

Chip and Pin Security:

The Forex Card is equipped with advanced chip and pin technology for enhanced security. This feature significantly reduces the risk of unauthorized card use and protects your funds from fraud.

Navigating Foreign Currency Markets

Understanding the basics of foreign currency markets is essential for effective financial planning when traveling or conducting business abroad.

Understanding Exchange Rates:

Exchange rates represent the value of one currency relative to another. Fluctuations in exchange rates can significantly impact your spending power. The Forex Card helps you stay informed about the latest exchange rates and make informed décisions.

Factors Affecting Exchange Rates:

Various factors affect exchange rates, including economic fundamentals, interest rates, political stability, and supply and demand. It’s important to stay updated on these factors to anticipate potential currency fluctuations.

Exchange Rate Volatility:

Exchange rates can be volatile, making it challenging to predict future rates. The Forex Card provides you with the flexibility to lock in favorable rates to minimize the impact of currency fluctuations.

Standard Chartered Bank Forex Card Rates

Conclusion

The Standard Chartered Bank Forex Card is an indispensable tool for managing foreign currency seamlessly and efficiently. By integrating convenience, flexibility, competitive exchange rates, multiple currency management, security, and global acceptance, the Forex Card empowers you to navigate the world of international finance with confidence and ease. Embrace the benefits of the Forex Card today and experience the freedom and peace of mind that comes with simplified global financial management.