Title: Unleash the Power of Pending Orders: A Comprehensive Guide for Forex Traders

Image: howtotradeblog.com

Introduction:

In the dynamic world of forex trading, timing is everything. Placing pending orders allows traders to capitalize on market fluctuations without the need for constant monitoring, empowering them to execute trades at precise price levels. Step into the world of pending orders and unlock the secrets to maximizing your trading potential.

Understanding Pending Orders:

Pending orders are instructions placed with your broker to trigger a trade when the market price reaches a predetermined level. Unlike market orders, which are executed immediately, pending orders remain dormant until the specified price condition is met. This foresightful approach grants traders the flexibility to plan their trades in advance and minimize the impact of emotions on decision-making.

Types of Pending Orders:

-

Buy Stop Order: Activated when the market price rises above a specified level, instructs the broker to buy an asset.

-

Sell Stop Order: Triggered when the market price falls below a specified level, directing the broker to sell an asset.

-

Buy Limit Order: Activated when the market price drops to a specified level, instructs the broker to buy an asset.

-

Sell Limit Order: Triggered when the market price rises to a specified level, directing the broker to sell an asset.

Advantages of Pending Orders:

-

Eliminate Market Volatility: Shielding traders from sudden price swings, pending orders ensure trades are executed at the desired price.

-

Plan Ahead: Traders can anticipate market movements and set up orders in advance, freeing them from real-time monitoring.

-

Maximize Opportunities: Pending orders allow traders to capture trades even when they are away from their trading screens.

-

Control Risk: By triggering trades only at specific price levels, pending orders help manage risk and limit potential losses.

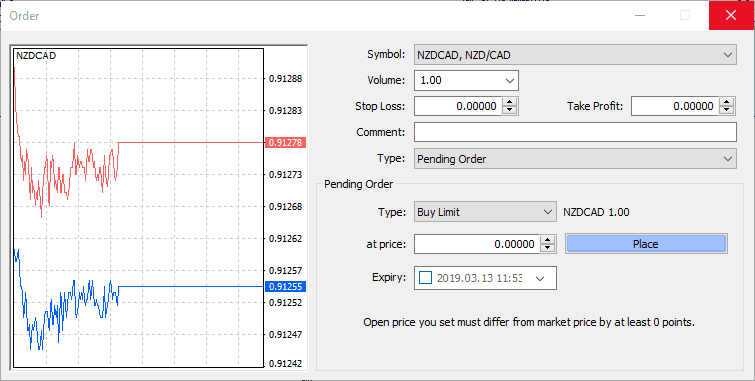

How to Place a Pending Order in Forex:

-

Identify Market Trends: Analyze technical indicators, fundamental news, and market sentiment to forecast market direction.

-

Determine Price Level: Use technical analysis techniques, such as support and resistance levels, to identify the optimal price level for your pending order.

-

Choose Order Type: Select the appropriate pending order type (stop or limit) based on the desired market direction.

-

Set Price: Specify the exact market price at which you want the order to trigger.

-

Set Stop-Loss and Take-Profit Levels: To manage risk and secure profits, define stop-loss and take-profit levels for each trade.

-

Place Order: Submit the pending order with your broker, providing clear instructions and parameters.

Expert Insights:

-

“Pending orders are a powerful tool for forex traders, allowing them to automate their trading strategies and mitigate the influence of emotions.” – Marc Faber, Renowned Forex Trader

-

“By utilizing trailing stops with pending orders, traders can effectively adapt their positions to changing market conditions and maximize their profit potential.” – Peter Brandt, Author and Technical Analyst

Conclusion:

Pending orders are a versatile tool that every forex trader should master. By understanding how to place and utilize pending orders effectively, traders gain control over their trades, optimize returns, and navigate the ever-changing market landscape with confidence. Embrace the transformative power of pending orders and unlock the full potential of your forex trading endeavors.

Image: forexretro.blogspot.com

How To Place Pending Order In Forex