Imagine yourself as a skilled currency trader, navigating the dynamic and thrilling world of forex trading. With each trade, you make strategic decisions that can lead to substantial gains or potential losses. To succeed in this exhilarating realm, mastering the art of calculating forex profit and loss is crucial. Embark on this educational journey as we delve into the intricate yet rewarding process of quantifying your financial outcomes in forex trading.

Image: mavink.com

Foundations: Understanding Forex and Profit

Forex, short for foreign exchange, is the market where global currencies are traded. In this dynamic marketplace, traders buy and sell different currencies in pairs, aiming to profit from fluctuations in their exchange rates. When you engage in a forex trade, you’re essentially speculating on the movement of one currency against another.

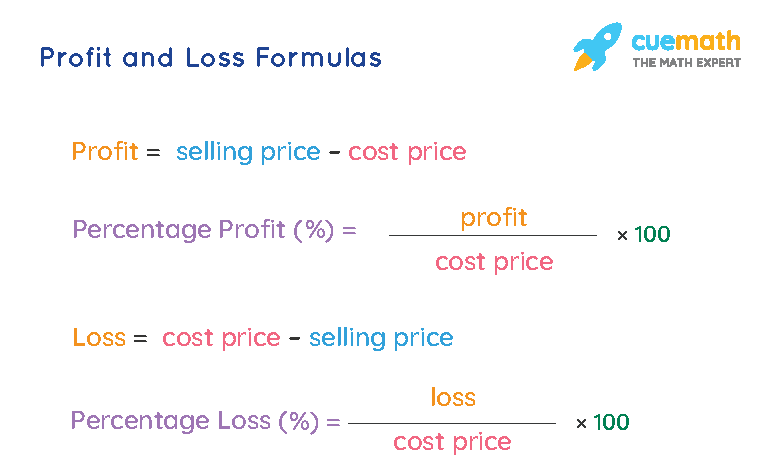

Profit, in forex trading, is the net gain you make on a trade. It’s the difference between your selling price and your buying price, minus any transaction costs (such as spreads or commissions). Whether your net gain turns out to be positive or negative will depend on the direction the currency pair moved in relation to your trade.

Step-by-Step Calculation of Forex Profit and Loss

Calculating your forex profit or loss is relatively straightforward. Let’s walk through the key steps involved:

-

Determine your trading strategy:

Before placing a trade, you need to define your entry and exit points, as well as the amount you wish to trade. -

Place your trade:

When you enter a trade, you’re committing to buy or sell a certain amount of a currency pair at a specific price. -

Monitor the trade:

Once your trade is in progress, it’s essential to monitor its performance in real time. -

Close the trade:

When the price of the currency pair reaches your target profit or stop-loss level, you can close the trade. -

Calculate your profit (or loss):

To calculate your profit or loss, use this formula:

Profit/Loss = (Closing Price - Opening Price) * Number of Currency Units TradedExample Calculation:

Let’s say you bought 1,000 units of the EUR/USD currency pair at an exchange rate of 1.1234. You then closed the trade when the exchange rate was 1.1278.

Profit/Loss = (1.1278 - 1.1234) * 1,000

Profit/Loss = 4.4 pipsIn this example, you would have made a profit of 4.4 pips on this trade.

Advanced Calculations: Pip Value and Pips Gained/Lost

Pip stands for “point in percentage.” It’s the smallest increment of price movement in the forex market. The pip value of a currency pair varies depending on the base currency and the quote currency.

Pip Value = (1 pip / Exchange Rate) * Number of Currency Units TradedPips gained or lost refer to the actual movement in the price of a currency pair. It’s calculated as the difference between the opening price and the closing price.

Pips Gained/Lost = Closing Price - Opening PriceUnderstanding pip value and pips gained/lost is crucial for accurate profit and loss calculations in forex trading.

Expert Tips for Accurate Calculations

- Use precise market data and real-time quotes.

- Double-check your calculations to minimize errors.

- Consider transaction costs such as spreads and commissions.

- Keep a trading journal to track your performance and identify areas for improvement.

Conclusion: Empowering You with Financial Knowledge

Mastering the calculation of forex profit and loss is a fundamental skill for success in currency trading. As you gain proficiency in this aspect, you empower yourself to make informed decisions, manage risk effectively, and enhance your overall trading performance. Embrace this knowledge as a key to unlocking financial freedom and navigating the dynamic world of forex with confidence.

Image: www.aximdaily.com

How To Calculate Forex Profit And Loss