Prologue: A Glimpse into the Global Forex Market

The foreign exchange (forex) market stands as a colossal financial behemoth, where currencies are exchanged at a global scale. Its daily trading volume dwarfs that of all other financial markets combined, reaching an astounding quadrillion US dollars. This vast arena presents boundless opportunities for traders seeking financial freedom, but it also conceals a multitude of pitfalls. Amidst the allure of potential wealth lies a fundamental question that has plagued traders for decades: “How many forex traders are profitable?”

Image: www.californiaherald.com

In this exhaustive analysis, we embark on an odyssey to unravel this enigma, delving into the intricacies of forex trading and exploring the factors that determine profitability. Through meticulous research and insights from seasoned experts, we aim to illuminate this enigmatic landscape, empowering aspiring traders with the knowledge they need to navigate its challenges and grasp its rewards.

The Realities of Forex Trading: A Path Paved with Challenges

The allure of forex trading stems from its accessibility and the potential for substantial profits. However, it’s imperative to acknowledge that the path to profitability is fraught with challenges. The market is inherently volatile and unpredictable, governed by a complex web of economic, political, and social factors.

Contrary to popular belief, forex trading is not a get-rich-quick scheme. It demands unwavering discipline, meticulous risk management, and a deep understanding of market dynamics. Novice traders often underestimate the complexities involved and find themselves entangled in a maze of losses.

Unmasking the Profitability Conundrum: A Quest for Answers

The precise proportion of profitable forex traders remains an elusive statistic. Various studies and surveys have produced conflicting estimates, ranging from a dismal 5% to an optimistic 30%. These discrepancies stem from the subjective nature of profitability, influenced by individual trading strategies, risk tolerance, and market conditions.

Nonetheless, the consensus among experts suggests that the majority of forex traders struggle to achieve consistent profitability. The allure of quick profits and the absence of formal training often lead to impulsive trading decisions, exacerbating losses.

A Blueprint for Profitability: Unveiling the Secrets of Successful Traders

While the path to forex profitability may seem arduous, it is not an unattainable dream. Seasoned traders who have mastered the intricacies of the market share invaluable insights that can guide aspiring traders toward success.

-

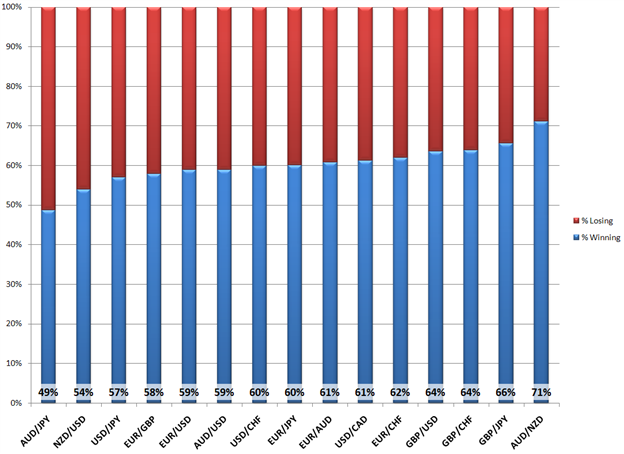

Image: www.dailyfx.comRigorous Risk Management: The Bedrock of Profitability

Discipline is paramount in forex trading, particularly regarding risk management. Successful traders strictly adhere to predetermined risk parameters, never wagering more than they can afford to lose. This conservative approach ensures survival during inevitable market fluctuations.

-

Unwavering Patience: A Virtue in the Face of Uncertainty

Patience is a defining trait of profitable traders. They refrain from chasing quick profits and instead adopt a long-term mindset. They meticulously analyze market trends and wait for opportune moments to execute trades.

-

Emotional Intelligence: Mastering the Inner Game of Trading

Trading entails constant decision-making under pressure. Emotional intelligence is crucial in preventing impulsive trades driven by fear or greed. Successful traders cultivate emotional discipline, maintaining a level head in the face of market turbulence.

-

Unceasing Education: An Investment in Success

The forex market is perpetually evolving, and traders must continuously update their knowledge and skills. Successful traders dedicate themselves to ongoing education, voraciously consuming market analysis, attending webinars, and engaging in mentorship programs.

Navigating the Forex Labyrinth: A Guide for Aspiring Traders

For aspiring traders eager to venture into the realm of forex, there are proven strategies to enhance their chances of success:

-

Embrace a Realistic Mindset: Volatility is Your Constant Companion

Recognize the inherent volatility of the forex market and set realistic profitability goals. Accept that losses are an inevitable aspect of trading and never let emotions cloud your decision-making.

-

Practice Discipline: The Foundation of Prudent Trading

Adhere to a predefined trading plan and risk management strategy. Avoid impulsive trades and never compromise your trading discipline, even during market fluctuations.

-

Seek Knowledge: The Path to Market Mastery

Commit to continuous learning, studying market fundamentals, technical analysis, and risk management. Attend webinars, read industry publications, and seek guidance from experienced traders.

-

Test Your Strategies: Prove Your Mettle in the Simulated Arena

Before venturing into live trading, test your strategies on a demo account. This risk-free environment allows you to refine your approach without jeopardizing capital.

-

Manage Your Expectations: Success is a Gradual Ascent

Building consistent profitability in forex trading takes time and patience. Avoid the allure of quick profits and focus on gradual improvement. Set realistic goals and track your progress diligently.

How Many Forex Traders Are Profitable

Conclusion: Unveiling the Path to Forex Success

The path to profitability in forex trading is a rigorous journey that requires unwavering dedication, emotional intelligence, and a profound understanding of market dynamics. While the precise percentage of profitable traders remains a matter of debate, experts concur that consistent success is reserved for those who possess the discipline, patience, and knowledge to navigate the market’s complexities.

For aspiring traders, the road ahead may seem daunting, but remember that success is not an elusive mirage. By embracing a realistic mindset, practicing discipline, seeking knowledge, and managing expectations, you can progressively increase your chances of thriving in the ever-evolving world of forex trading.