In the realm of finance, the foreign exchange market, or forex, stands as an alluring yet complex beast. As a global hub where currencies are traded like commodities, forex presents a vast network of opportunities and potential pitfalls. One of the foundational pillars of forex trading lies in understanding the interplay between buying and selling currencies. Let’s embark on a journey to unravel this fundamental mechanism that drives the forex market.

Image: www.forextraders.com

Understanding the Forex Market

The forex market, the world’s largest financial market, operates 24 hours a day, 5 days a week, connecting buyers and sellers of currencies around the globe. Unlike stock or bond markets, forex trading has no centralized exchange; rather, it is an over-the-counter (OTC) network of banks, brokers, and other financial institutions that facilitate currency transactions. This globalized nature creates a vibrant and constantly evolving marketplace where currency prices fluctuate in response to economic, political, and societal factors.

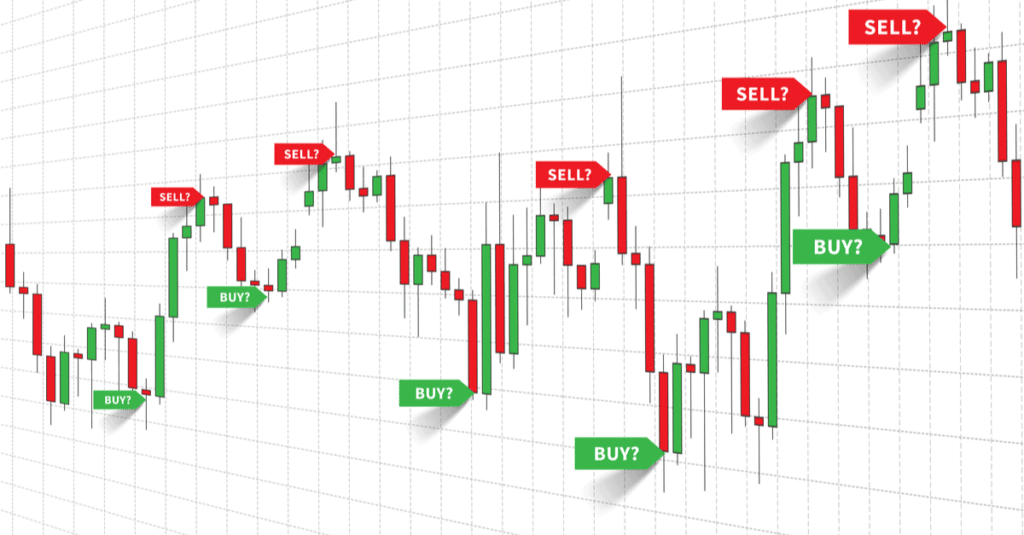

Buy and Sell: The Forex Trading Engine

At the heart of forex trading lies the concept of “buying” and “selling” currencies. When you “buy” a currency pair, such as EUR/USD, you are essentially purchasing the first currency (EUR) while simultaneously selling the second currency (USD). Conversely, when you “sell” a currency pair, you are selling the first currency while buying the second.

This seemingly simple exchange, however, carries profound implications. Buying a currency signifies your belief that its value will appreciate relative to the currency you are selling. Selling a currency, on the other hand, indicates your expectation that its value will depreciate in comparison to the currency you are buying.

Currencies: The Players in the Forex Game

In the forex market, currencies are paired and traded against each other. The first currency in a pairing is called the base currency, while the second currency is known as the quote currency. For instance, in the EUR/USD pairing, EUR is the base currency, and USD is the quote currency. The value of the base currency relative to the quote currency is known as the exchange rate.

Image: tradefx.co.za

Currency Quotes: Deciphering the Language of Forex

The price of a currency pair is expressed as a quote, which is a reflection of the exchange rate between the two currencies. Quotes are typically displayed in the following format:

Base Currency / Quote Currency = Exchange RateFor example, a quote of EUR/USD = 1.20 indicates that one euro is worth 1.20 US dollars. This means that if you buy EUR/USD at this rate, you will receive 1.20 US dollars for each euro you purchase.

The Role of Brokers: Facilitating Forex Trading

Forex trading is made possible through intermediaries called brokers. These regulated financial institutions act as bridges between buyers and sellers by providing a platform for currency exchange. Forex brokers offer a range of services, including real-time market data, trading platforms, and leverage, allowing traders of varying levels of experience to access the forex market.

Buying and Selling Strategies: Navigating the Forex Landscape

In the forex market, there is no shortage of trading strategies employed by participants. Some common strategies include:

-

Scalping: Involves executing numerous small trades within a short time frame, profiting from small price fluctuations.

-

Day trading: Buying and selling currencies within the same trading session, aiming to generate profits before the markets close for the day.

-

Swing trading: Holding onto trades for several days or weeks, capitalizing on larger market movements.

-

Trend trading: Trading in line with established market trends, buying when prices are rising (uptrend) and selling when prices are falling (downtrend).

-

Carry trading: Borrowing currencies with low interest rates and investing them in currencies with higher interest rates, profiting from the interest rate differential.

Risk and Reward: The Balancing Act of Forex

Forex trading, while potentially lucrative, carries inherent risks. Currency market volatility can result in substantial losses if proper risk management strategies are not in place. Factors such as economic news, political events, and natural disasters can trigger significant price fluctuations, making it crucial for traders to manage their risk by understanding their risk tolerance, using stop-loss orders, and diversifying their portfolio.

How Does Buy And Sell Work In Forex

Conclusion: Empowering Forex Traders with Knowledge

Understanding the intricacies of buying and selling in forex is fundamental to navigating this dynamic and rewarding market. By grasping the exchange rate, currencies, brokers, trading strategies, and risk management principles, traders can equip themselves with the knowledge and tools necessary to make informed decisions and achieve their financial goals. Remember, in the realm of forex, knowledge is the cornerstone of success, empowering traders to unlock the market’s potential while mitigating its risks.