In the tumultuous world of international finance, countries rely heavily on foreign exchange reserves to safeguard their economic stability and prosperity. And among the nations that hold a commanding position in this domain is India, with the fourth-largest forex reserve globally. In this in-depth analysis, we will delve into the significance of India’s robust forex reserves, examining their origins, composition, and impact on the nation’s economic trajectory.

Image: www.civilsdaily.com

The Genesis of India’s Forex Might

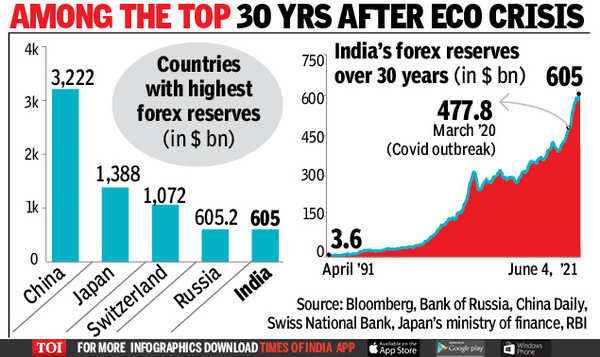

India’s forex reserves have witnessed a remarkable growth trajectory, from a mere US$5.8 billion in 1991 to a staggering US$633.5 billion as of September 2023. This remarkable surge can be attributed to several factors, including:

-

- Increased exports: India’s exports have grown exponentially in recent years, leading to an inflow of foreign exchange. This surge in exports is driven by various sectors, including pharmaceuticals, textiles, and engineering goods.

-

- Foreign direct investment (FDI): India has attracted significant foreign direct investment, particularly in sectors such as technology, manufacturing, and infrastructure. This influx of FDI has contributed to the country’s forex reserves.

-

- Remittances from overseas Indians: Indian expatriates have been diligently sending remittances back home, which contribute to the forex reserves. These remittances play a crucial role in supporting the Indian economy.

Composition of India’s Forex Kitty

India’s forex reserves are primarily composed of the following assets:

-

- Foreign currency assets: These constitute the most significant portion of the forex reserves and include holdings of major currencies such as the US dollar, euro, yen, and pound sterling.

-

- Gold: India holds substantial gold reserves, reflecting the cultural and traditional significance attached to gold in the country.

-

- Special drawing rights (SDRs): SDRs are an international reserve asset created by the International Monetary Fund (IMF). India’s allocation of SDRs forms part of its forex reserves.

The Role of Forex Reserves in Economic Stability

Robust forex reserves play a pivotal role in maintaining a country’s economic stability in multiple ways:

-

- Import cover: Forex reserves provide import cover for a country, ensuring that it has sufficient foreign exchange to pay for essential imports, such as oil and machinery, even during periods of economic uncertainty.

-

- Currency stability: Forex reserves act as a buffer against external shocks and help stabilize the value of a country’s currency. This stability attracts foreign investment and promotes economic growth.

-

- Debt repayment: Forex reserves enable a country to repay its external debt obligations, such as sovereign bonds and loans, on time and prevent sovereign default.

-

- Confidence and credibility: Ample forex reserves boost investor confidence in a country’s economy, making it more attractive for foreign investment and economic partnerships.

Image: currentaffairs.adda247.com

Investing Forex Reserves: A Prudent Approach

The Reserve Bank of India (RBI), the country’s central bank, is responsible for managing the forex reserves. The RBI prudently invests these reserves to generate returns and diversify risks. The investment strategy focuses on low-risk, liquid assets that preserve capital and generate a stable income.

Highest Forex Reserve Of India

India’s Forex Reserve: A Symbol of Strength

India’s towering forex reserves stand as a testament to the country’s economic resilience and unwavering financial strength. They provide the nation with a buffer against global economic headwinds and position it as a significant player in the international financial system. The Indian government and the RBI are committed to maintaining and augmenting these reserves to ensure the country’s continued economic prosperity.

This comprehensive analysis of India’s forex reserves highlights their profound significance not only for the nation but also for the global economy. As the world navigates an increasingly volatile and uncertain economic landscape, countries with robust forex reserves, like India, will undoubtedly have a distinct advantage in weathering future financial storms and seizing growth opportunities.