In the contemporary era of globalization and seamless travel, navigating foreign currencies can be a daunting task. HDFC Bank’s Regalia Forex Card offers a groundbreaking solution, empowering you to manage your finances effortlessly while exploring the world.

Image: invested.in

The Regalia Forex Card serves as your financial passport, providing the convenience of carrying multiple currencies on a single card. Its unparalleled acceptance at over 60 million merchants worldwide ensures your transactions are secure and hassle-free.

Benefits of Embracing the HDFC Bank Regalia Forex Card

- Unmatchable Convenience: The Regalia Forex Card consolidates multiple currencies, eliminating the need for carrying bulky cash and managing multiple currency exchange accounts.

- Exceptional Security: Equipped with advanced chip technology and EMV compliance, the card ensures the highest levels of security, safeguarding your financial transactions in real-time.

- Real-Time Currency Management: Monitor your card’s balance and recent transactions in real-time through net banking or mobile banking, offering complete visibility and control over your finances.

- Competitive Exchange Rates: HDFC Bank leverages its strategic partnerships to provide highly competitive exchange rates, ensuring that you maximize the value of your foreign currency transactions.

- Exclusive Benefits and Rewards: As a Regalia Forex Cardholder, you’re entitled to a plethora of exclusive benefits and rewards, elevating your travel and banking experience.

Comprehensive Overview of HDFC Bank Regalia Forex Card:

The HDFC Bank Regalia Forex Card is a prepaid, multicurrency card designed to empower international travelers with unmatched convenience and financial flexibility. Available in variants accommodating multiple currencies, the card offers a single platform for managing travel expenses, business transactions, and personal payments overseas.

Its intuitive interface and dedicated mobile application provide real-time access to account information, transaction details, and currency conversion rates. The card is widely accepted across a global network of merchants, ensuring seamless transactions in over 200 countries and territories.

Expert Tips for Unleashing the Power of Your HDFC Bank Regalia Forex Card

- Activate your card prior to your international journey to avoid any inconvenience during transactions.

- Load multiple currencies to maximize the convenience of a single card for all your international expenses.

- Monitor exchange rates and choose the most favorable time to load currencies to optimize your transactions.

- Utilize the card’s dedicated mobile application for real-time account management and currency conversion.

- Keep a record of your transactions for easy expense tracking and reconciliation upon your return.

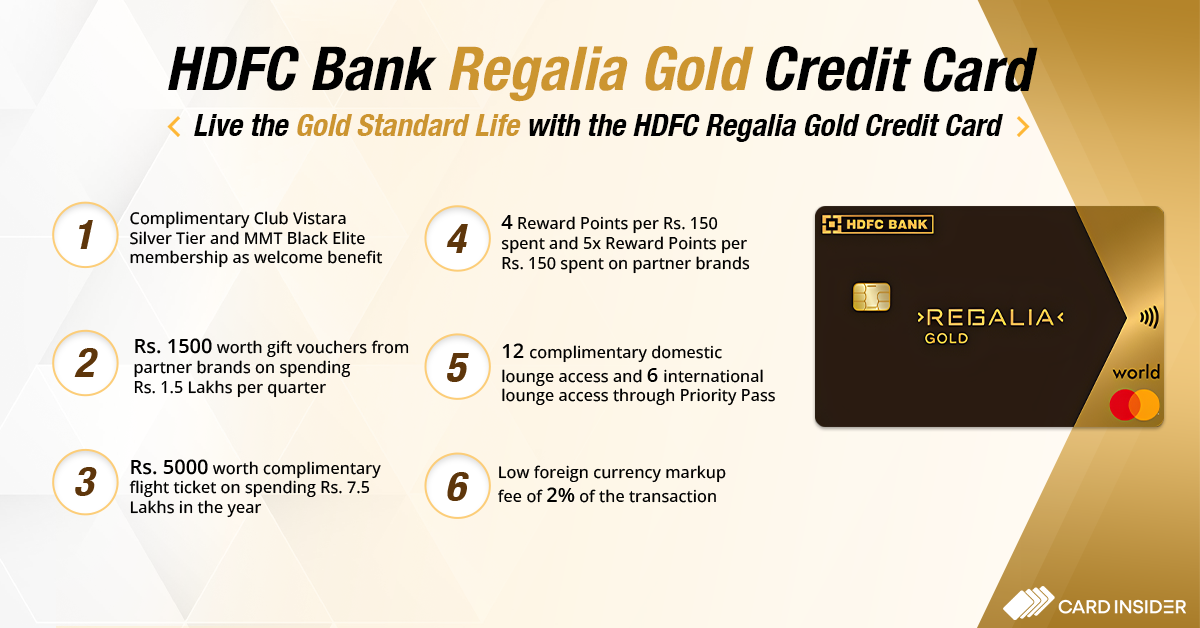

Image: cardinsider.com

FAQs on HDFC Bank Regalia Forex Card:

Q: Can I use my Regalia Forex Card for all international payments?

A: Yes, the card is widely accepted for payments at merchants, hotels, restaurants, and online retailers worldwide.

Q: How can I check the balance and transaction history of my Forex Card?

A: You can access your account information, balance, and transaction history through net banking or the dedicated mobile application.

Q: Are there any transaction limits associated with the Forex Card?

A: Yes, there are daily and monthly transaction limits set to ensure responsible financial management. These limits can be customized upon request.

Hdfc Bank Regalia Forex Card Login

Conclusion: Embracing Convenience and Financial Freedom with HDFC Bank Regalia Forex Card

The HDFC Bank Regalia Forex Card revolutionizes the world of international currency management, offering an unmatched combination of convenience, security, and value. Its comprehensive features and exclusive benefits empower travelers and global citizens alike, ensuring seamless financial experiences across borders.

Are you ready to unlock the world of global currency management with the HDFC Bank Regalia Forex Card? Explore its benefits today and embrace the seamless experience of managing your finances abroad.