Introduction

Navigating foreign currencies can be daunting when traveling abroad. From understanding exchange rates to managing multiple currencies, it can add an unnecessary layer of stress to your trip. The HDFC Forex Card offers a convenient solution to these challenges, providing you with a secure and easy way to manage your travel expenses. In this article, we’ll delve into the world of the HDFC Forex Card, exploring its benefits, recharge process, and how it can enhance your travel experience.

Image: livefromalounge.com

Advantages of the HDFC Forex Card

The HDFC Forex Card is a prepaid card specifically designed for international travelers. It offers several advantages over traditional methods of carrying cash or using credit cards abroad:

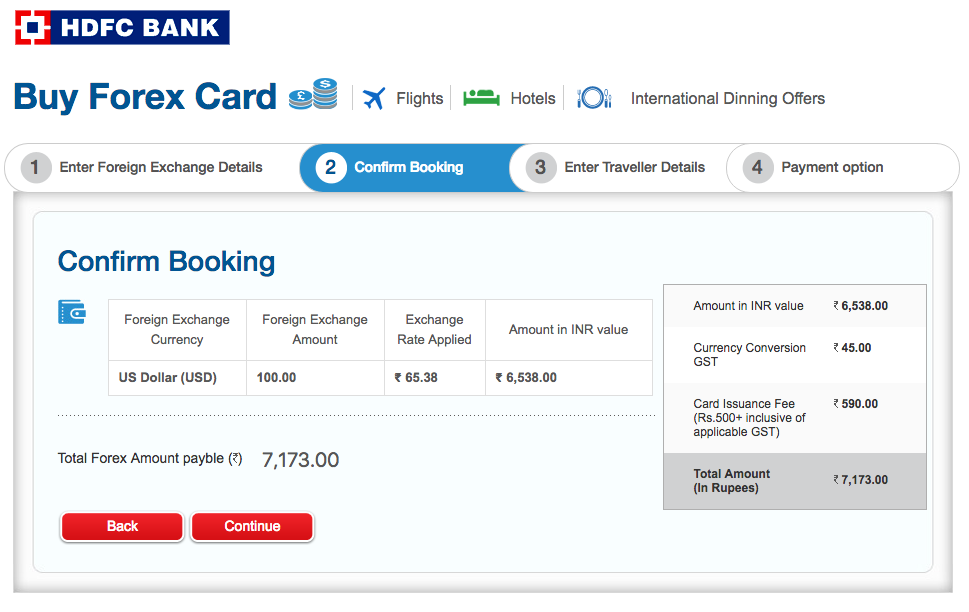

- Competitive exchange rates: HDFC offers highly competitive exchange rates, ensuring that you get the most value for your money.

- Multiple currency options: The card allows you to load multiple currencies onto a single card, eliminating the hassle of managing multiple cards or exchanging currency at every destination.

- Wide acceptance: The HDFC Forex Card is accepted at over 40 million merchants and ATMs worldwide, providing you with access to your funds almost anywhere you go.

- Enhanced security: The card is equipped with advanced security features, such as chip-and-PIN technology and SMS alerts, to protect your funds against fraud and unauthorized access.

- Convenience: The card can be used for both in-store purchases and online transactions, eliminating the need to carry large amounts of cash or worry about lost or stolen cards.

HDFC Forex Card Recharge

To recharge your HDFC Forex Card, you can use the following methods:

- NetBanking: Log in to your HDFC Bank NetBanking account, select the “Forex Card” option, and follow the instructions to recharge your card.

- HDFC Mobile Banking App: Use the HDFC Mobile Banking App on your smartphone to recharge your card.

- Visit an HDFC Bank Branch: Visit your nearest HDFC Bank branch with your Forex Card and the required amount in cash or through a debit card swipe.

- International SMS: While abroad, you can also recharge your card through international SMS. Simply send an SMS with the amount you wish to recharge and your card number to +919867600668.

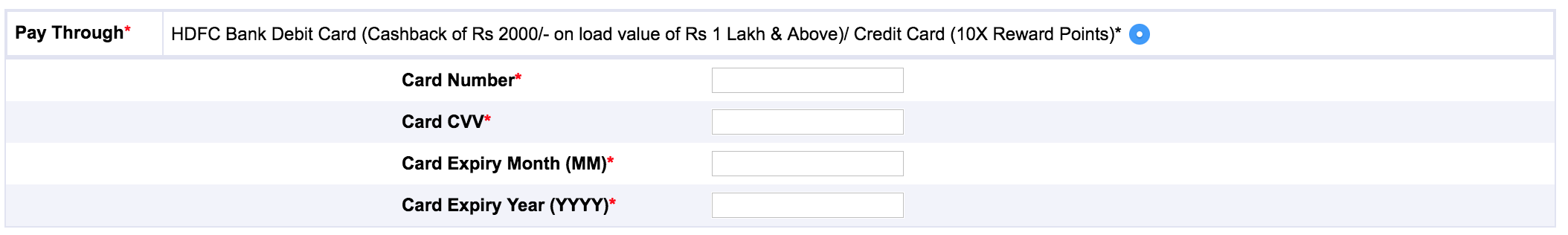

Steps to Recharge Your Forex Card

- Gather your details: You will need your HDFC Forex Card number and the amount you wish to recharge.

- Choose a recharge method: Select the recharge method that suits you best, as explained above.

- Initiate the recharge: Depending on the recharge method you choose, follow the instructions provided to initiate the recharge process.

- Confirmation: Once the recharge is complete, you will receive a confirmation message or SMS with the updated balance on your Forex Card.

Image: jilllextre.blogspot.com

Enhancing Your Travel Experience with the HDFC Forex Card

The HDFC Forex Card can significantly enhance your travel experience by providing:

- Peace of mind: Knowing that your money is secure and accessible gives you peace of mind while traveling in unfamiliar places.

- Control over expenses: The card allows you to budget your spending and track your expenses easily, preventing overspending and keeping your finances organized.

- Convenience: The ability to use the card for both purchases and cash withdrawals eliminates the need to carry large amounts of cash or search for money exchange counters.

- Emergency assistance: In case of any emergencies or card-related issues, you can contact HDFC Customer Service for immediate assistance.

Hdfc Bank Forex Card Recharge

https://youtube.com/watch?v=L80Hcko_Xpk

Conclusion

The HDFC Forex Card is an indispensable tool for travelers seeking a convenient, secure, and hassle-free solution to managing their finances abroad. With its competitive exchange rates, multiple currency options, enhanced security, and easy recharge process, the card provides you with the peace of mind and flexibility to explore the world without financial worries. Embrace the ease of the HDFC Forex Card and embark on your next adventure with confidence, knowing that your finances are taken care of.