Forex trading, the thrilling realm of currency exchange, presents traders with a complex symphony of economic forces that challenge even seasoned investors. Amidst this whirlwind of financial data, two key analytical approaches guide traders in navigating market fluctuations: fundamental analysis and technical analysis.

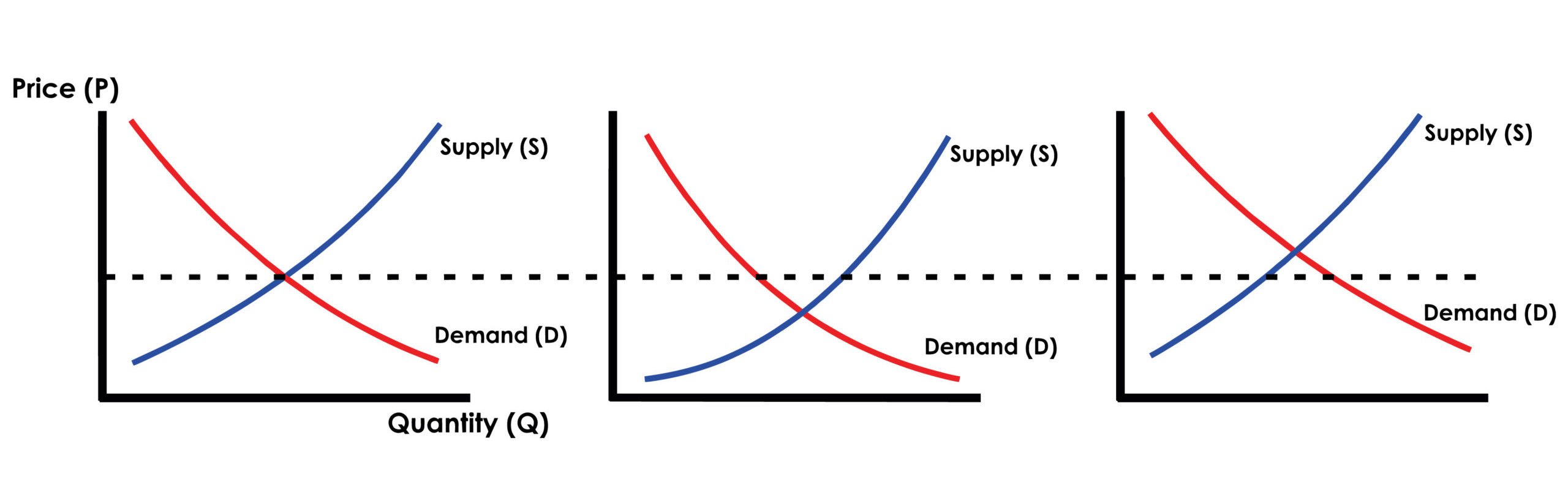

Image: mytradingskills.com

In this comprehensive guide, we will delve into the world of forex analysis, exploring the fundamentals that shape currency movements and the technical indicators that delineate trading opportunities. With a grasp of both techniques, traders can refine their decision-making and elevate their trading prowess.

What is Fundamental Analysis?

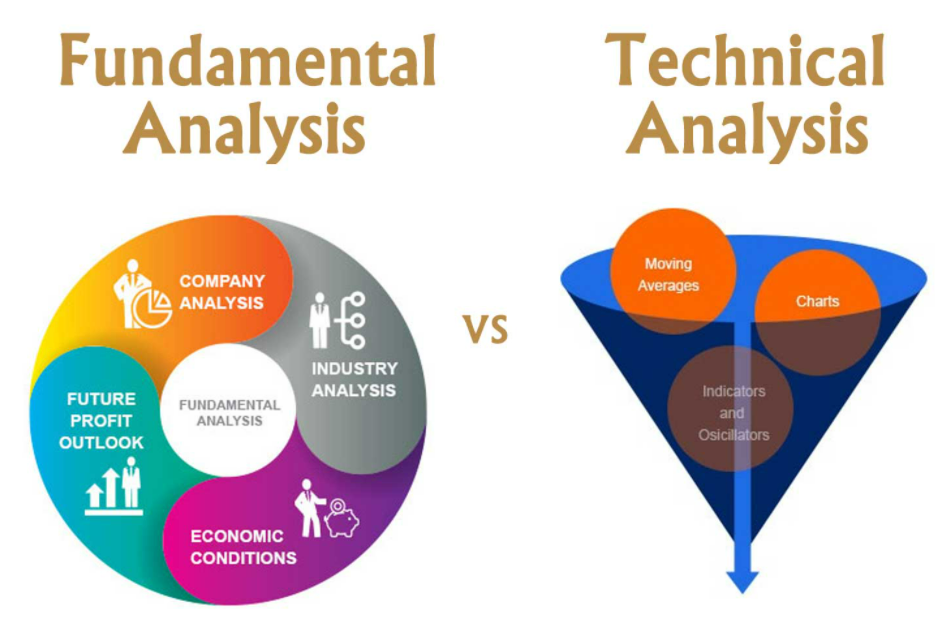

Fundamental analysis, like a keen detective, scrutinizes the economic and political factors that influence currency valuations. It investigates a country’s economic health, assessing its gross domestic product (GDP), inflation rates, employment figures, and fiscal policies. By dissecting these key indicators, fundamental analysts gain insights into a currency’s intrinsic value.

On the international stage, fundamental analysis examines trade imbalances, exchange rate policies, and foreign direct investment. These factors shape a currency’s global perception and its interplay with other currencies. By deciphering these macroeconomic influences, fundamental analysts identify potential drivers of future currency movements.

What is Technical Analysis?

In contrast to fundamental analysis’s economic focus, technical analysis adopts the charting technique, making it the “seer” of the forex market. It studies historical price data and identifies patterns, trends, and indicators that reveal likely future movements. This approach leverages price action alone, entirely disregarding the economic and political factors dissected in fundamental analysis.

Technical analysts often begin by examining price charts to identify major trends. They then utilize a myriad of technical indicators, such as moving averages, support and resistance levels, and candlestick patterns. These tools offer a comprehensive tableau of market dynamics, allowing traders to predict potential turning points in the currency’s trajectory.

The Interplay of Fundamental and Technical Analysis

While fundamental and technical analysis are often pitted against each other, the most successful traders acknowledge their complementary relationship. Fundamental analysis provides the economic context and intrinsic value estimates, while technical analysis identifies trading opportunities within those parameters.

For example, a fundamental analyst may forecast a currency’s appreciation based on positive economic indicators. Armed with this knowledge, a technical analyst can then employ specific chart patterns to identify the optimal entry and exit points for trading.

Image: www.forex.academy

Tips and Expert Advice for Enhancing Forex Trading

To fully unlock the potential of forex trading, both fundamental and technical analysis should be refined with expert guidance and practical tips:

- Stay Informed: Continuously monitor economic releases and financial news, as market events and news updates can dramatically impact currency valuations.

- Understand Price Patterns: Familiarize yourself with the plethora of technical indicators and price patterns that signify potential trading opportunities.

- Manage Risk Wisely: Implement strict risk management strategies to safeguard your trading capital during market fluctuations.

- Practice Discipline: Develop a structured trading plan and adhere to it, avoiding emotional decision-making.

- Seek Education: Invest in ongoing education and stay abreast of market trends, analysis techniques, and trading tools.

Frequently Asked Questions (FAQs)

Q: Is fundamental or technical analysis a better approach?

A: Both fundamental and technical analysis offer valuable insights for informed trading decisions.

Q: Which technical indicators are essential for forex trading?

A: Key indicators include moving averages, support and resistance levels, stochastic oscillators, and candlestick patterns.

Q: How do I incorporate fundamental and technical analysis into my trading strategy?

A: Conduct fundamental analysis to identify potential long-term trends, then use technical analysis to pinpoint strategic trading opportunities.

Fundamental Vs Technical Analysis Forex

Conclusion

In the captivating domain of forex trading, fundamental and technical analysis serve as indispensable tools for navigating currency markets. Understanding the economic forces that drive currency valuations and the technical indicators that predict price movements empowers traders to seize opportunities and manage risks effectively. By embracing both approaches, traders can refine their decision-making, enhance their trading skills, and embark on a path toward financial success.

Now, ask yourself: Are you ready to delve into the intricacies of forex analysis and unleash your trading potential?