Introduction

In the tumultuous world of global finance, where economic headwinds can swiftly topple nations, India stands tall as a beacon of stability thanks to its robust foreign exchange (forex) reserves. These reserves play a crucial role in mitigating external shocks, ensuring the nation’s economic growth and prosperity. This comprehensive article delves into the significance of India’s forex reserves, analyzing the latest trends, and exploring expert insights to empower readers with a deep understanding of this vital pillar of the Indian economy.

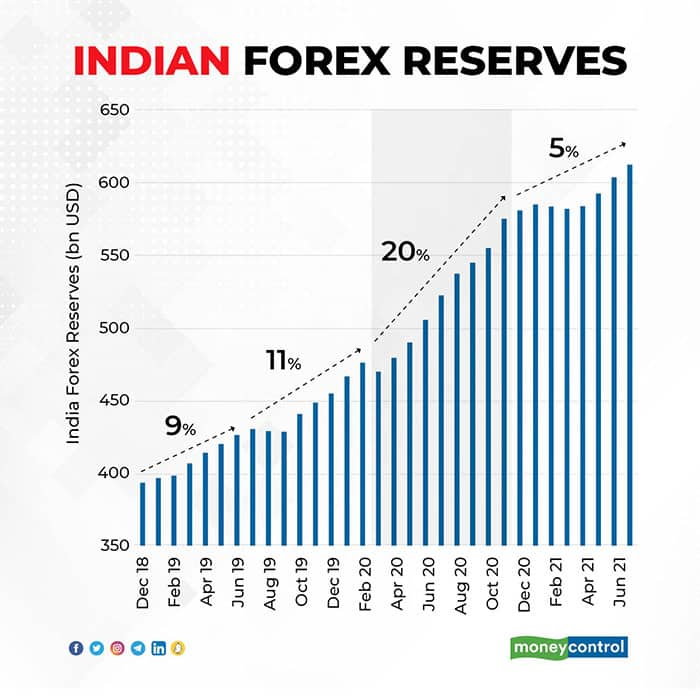

Image: www.moneycontrol.com

Understanding Forex Reserves

Forex reserves, simply put, are the stockpile of foreign currencies and gold held by the central bank of a country. They act as a buffer against economic vulnerabilities, safeguarding the nation from financial turmoil. These reserves are accumulated through various means, such as trade surpluses, foreign direct investment, and remittances from overseas workers. India’s forex reserves play a pivotal role in:

- Maintaining Currency Stability: Adequate forex reserves enable the central bank to intervene in the foreign exchange market, stabilizing the value of the Indian rupee against external fluctuations. This prevents sharp currency depreciations that can disrupt businesses, fuel inflation, and erode consumer confidence.

- Ensuring Import Cover: India relies heavily on imports for its economic growth. Forex reserves bridge the gap between the foreign exchange needed for imports and the earnings from exports, reducing the risk of supply-chain disruptions and inflationary pressures.

- Repaying Foreign Debt: Government borrowings from international lenders are denominated in foreign currencies. Forex reserves serve as a reliable source of funds to meet foreign debt obligations, upholding India’s creditworthiness and reducing exchange rate risks.

- Maintaining Confidence in the Economy: Robust forex reserves instill trust among global investors and credit rating agencies, signaling India’s financial stability and resilience. This, in turn, attracts foreign capital, supports economic growth, and stabilizes the markets.

Growth Trajectory and Composition

India’s forex reserves have witnessed a steady upward trajectory, reaching a record high of $633.5 billion as of February 2023. This remarkable growth is primarily attributed to a sustained trade surplus, healthy foreign direct investment inflows, and a stable rupee. The composition of the reserves has also undergone a gradual shift, with a larger share now held in foreign currencies and a smaller proportion in gold. This diversification enhances the overall resilience of the reserves.

Expert Perspectives

“India’s forex reserves have grown steadily over the years, creating a buffer against external shocks and supporting the country’s economic growth,” said Dr. Raghuram Rajan, former Governor of the Reserve Bank of India. “Maintaining a healthy level of reserves is essential for macroeconomic stability and investor confidence.”

“These reserves provide India with the flexibility to intervene in the foreign exchange market, preventing excessive volatility and ensuring exchange rate stability,” added Dr. Arvind Subramanian, a renowned economist and former Chief Economic Adviser to the Government of India.

Image: www.civilsdaily.com

Forex Reserve Of India 2018

Conclusion

India’s forex reserves are a vital pillar of the nation’s economic well-being. They act as a shield against external shocks, bolster the stability of the rupee, and provide confidence to investors. As the global economy undergoes constant flux, robust forex reserves will continue to play a critical role in safeguarding India’s growth trajectory amidst the vagaries of international markets. Understanding the significance of these reserves empowers individuals, businesses, and policymakers alike to navigate financial uncertainties and contribute to India’s sustained economic progress.