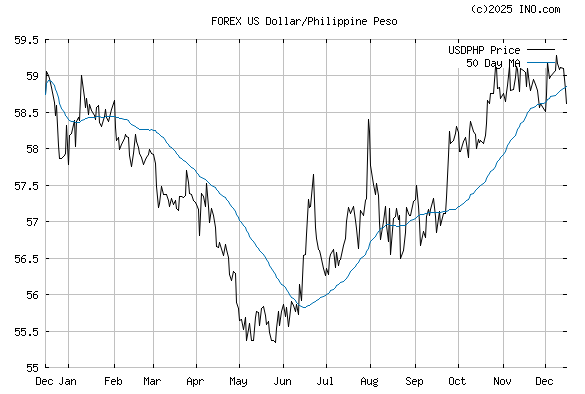

The Philippine peso (PHP) has long been pegged to the US dollar (USD), with an exchange rate that fluctuates constantly. This fluctuation presents both opportunities and challenges for Filipinos looking to make informed financial decisions. Understanding the ins and outs of forex in the Philippines can empower individuals to navigate the market wisely and maximize their gains.

Image: quotes.ino.com

What is Forex?

Forex, short for foreign exchange, refers to the global market where different currencies are traded. It is the most traded market in the world, with a daily turnover of trillions of dollars. In the Philippines, forex trading is regulated by the Bangko Sentral ng Pilipinas (BSP) and is conducted over-the-counter through various authorized dealers like banks, brokers, and online platforms.

Factors Influencing the Peso-Dollar Exchange Rate

Multiple factors influence the peso-dollar exchange rate, including:

- Interest rates: Higher interest rates in the Philippines compared to the US tend to strengthen the peso.

- Inflation: Higher inflation in the Philippines weakens the peso’s value.

- Economic data: Positive economic data, such as strong GDP growth, can boost investor confidence and strengthen the peso.

- Political stability: Political uncertainty or instability can negatively impact the peso’s value.

- Global economic conditions: Major events like global recession or crises can impact the global currency market, including the peso.

Benefits of Forex Trading in the Philippines

Forex trading offers several benefits to Filipinos, including:

- Potential to profit: Forex traders aim to buy currencies at lower rates and sell them at higher rates, potentially generating profit.

- Hedge against inflation: When the peso weakens against the dollar, forex trading can provide a hedge against inflation.

- Speculative opportunities: Forex trading allows traders to speculate on currency movements and potentially profit from short-term fluctuations.

- 24/7 market: Unlike traditional stock markets, the forex market operates 24 hours a day, five days a week, offering traders flexibility.

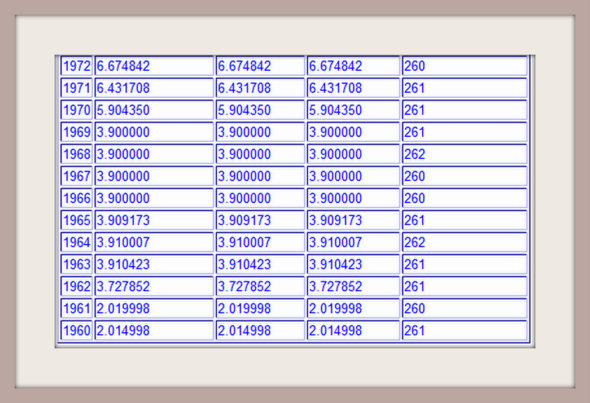

Image: www.noeimage.org

Risks of Forex Trading

While forex trading offers potential benefits, it also carries inherent risks:

- Market volatility: Currency exchange rates are constantly fluctuating, and traders face the risk of losses if the market moves against their positions.

- High leverage: Forex trading often involves leverage, amplifying potential profits but also increasing the risk of significant losses.

- Lack of regulation: Unauthorized forex dealers may pose additional risks to traders. It is crucial to choose reputable and regulated brokers.

- Emotional trading: Forex trading involves making quick decisions under pressure. Emotional trading can lead to poor judgment and losses.

Best Practices for Forex Trading in the Philippines

To trade forex in the Philippines successfully, consider the following practices:

- Choose a reputable forex broker: Verify that your chosen broker is regulated by the BSP and has a strong reputation in the industry.

- Educate yourself: Familiarize yourself with forex trading basics, including currency pairs, technical analysis, and risk management strategies.

- Start with a demo: Most forex brokers offer demo accounts where you can practice trading without risking real capital.

- Trade within your means: Determine a comfortable trading budget and stick to it to avoid excessive losses.

- Use stop-loss orders: Set stop-loss orders to minimize potential losses if the market moves against your position.

- Control your emotions: Maintain a disciplined approach and avoid making trades based on fear or greed.

Forex Philippines Dollar To Peso

Conclusion

Forex trading in the Philippines presents both opportunities and risks. By understanding the market, its influencing factors, and implementing sound trading practices, Filipinos can potentially benefit from forex trading while mitigating risks. Exploring the realm of forex can unlock new financial avenues and empower individuals to navigate the ever-evolving world of currency exchange.