In the fast-paced world of forex trading, time is of the essence. Multiple time frame analysis emerged as a powerful technique that empowers traders to make informed decisions by examining price action across different time periods. This comprehensive guide will delve into the intricacies of forex multiple time frame analysis, equipping you with the knowledge and skills to navigate the markets like a pro.

Image: www.pinterest.com

Unveiling the Concept of Multiple Time Frame Analysis

Multiple time frame analysis involves studying the price action of a currency pair over multiple time frames, from short-term (e.g., 5-minute charts) to long-term (e.g., monthly charts). By observing the larger time frame, traders can identify major trends and market movements, while the smaller time frames provide insights into short-term price fluctuations and momentum.

Identifying Trends and Market Conditions

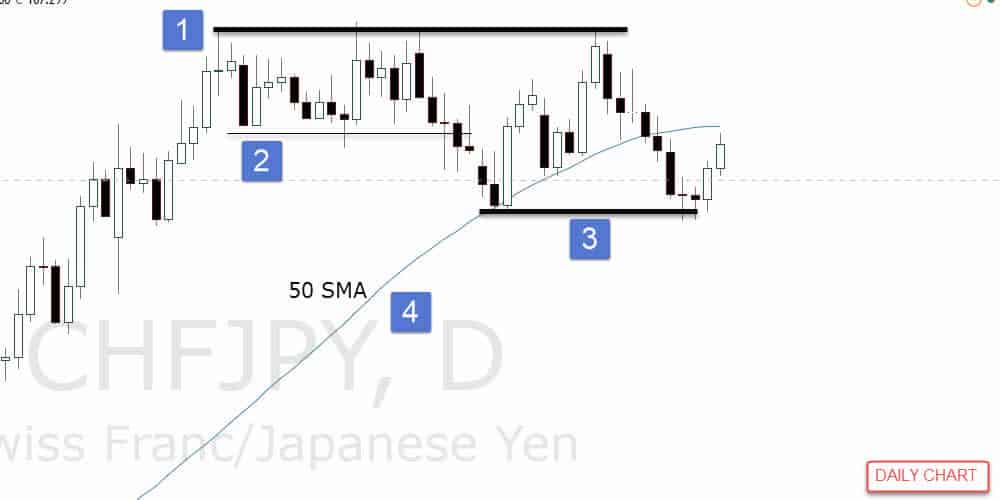

The key to successful multiple time frame analysis lies in aligning the trends across different time frames. When a currency pair is trending bullish on the daily chart and confirms the uptrend on the hourly chart, it increases the probability of a sustained uptrend. Conversely, if the daily trend is bearish and the hourly chart shows signs of a downtrend, a downtrend is likely to continue.

Multiple time frame analysis also helps traders identify market conditions such as support and resistance levels, candlestick patterns, and momentum indicators. By examining these elements on multiple time frames, traders can gain a deeper understanding of market sentiment, potential breakout points, and possible reversal zones.

Uncovering Trading Opportunities

Once trends, market conditions, and support and resistance levels are identified, multiple time frame analysis becomes a powerful tool for identifying trading opportunities. For instance, a trader might notice a bullish daily trend and a confirmation of the uptrend on the hourly chart. The trader can then look to the 5-minute chart to find a suitable entry point with a favorable risk-to-reward ratio.

Alternatively, if multiple time frames indicate a downtrend, the trader can use smaller time frames to identify potential entry points for short positions. By analyzing price action across different time periods, traders can increase their probability of catching profitable trades.

Image: www.netpicks.com

Tips and Expert Advice for Enhanced Analysis

– **Start with a clear trading plan:** Define your trading objectives, risk tolerance, and profit targets before using multiple time frame analysis.

– **Use multiple indicators and tools:** Combine trend lines, support and resistance levels, moving averages, and other indicators to enhance your analysis.

– **Pay attention to volume and volatility:** Analyze volume and volatility to identify potential market reversals or breakout opportunities.

– **Practice and test:** Apply multiple time frame analysis to historical charts to improve your trading skills and test different strategies.

Frequently Asked Questions (FAQs)

- Q: What are the benefits of using multiple time frame analysis?

- A: Provides a comprehensive market view, reduces noise, identifies trends and momentum shifts, improves trading accuracy.

- Q: Can I trade successfully using only one time frame?

- A: While it’s possible, using multiple time frames provides a more comprehensive understanding of market movements.

- Q: How many time frames should I use for analysis?

- A: Use a combination of higher (e.g., daily), medium (e.g., hourly), and lower time frames (e.g., 15-minute).

Forex Multiple Time Frame Analysis Pdf

Conclusion

Mastering the art of forex multiple time frame analysis empowers traders with a powerful tool for understanding market trends, identifying trading opportunities, and enhancing their overall trading decision-making process. By combining the insights from different time frames, traders can significantly increase their chances of trading success. So, embrace the power of multiple time frame analysis today and take your forex trading journey to the next level.

Are you ready to delve deeper into the world of forex multiple time frame analysis and unlock its full potential? Head over to our comprehensive Forex Multiple Time Frame Analysis PDF now!