Managing your finances on the go is essential when traveling abroad. It ensures you have instant access to your funds and peace of mind knowing your finances are in order. One way to simplify this is by using an ICICI Forex Card. This card offers a convenient and secure way to carry and use your funds when traveling overseas. In this blog post, we will delve into the details of this card and provide a step-by-step guide on how to check your ICICI Forex Card balance. Join us as we unlock the secrets to stress-free money management while traveling.

Image: www.forex.academy

Checking Your ICICI Forex Card Balance with Just a Few Clicks

Knowing your Forex Card balance is crucial when planning your expenses and avoiding any financial surprises. Here we present three simple methods you can use to check your ICICI Forex Card balance instantly:

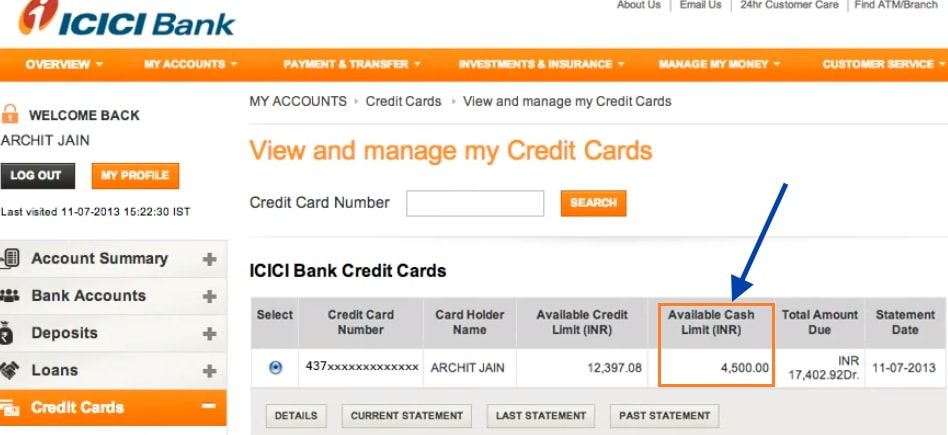

- ICICI Bank Net Banking: Utilize your internet banking credentials to log in to the ICICI Bank website or mobile application. Once logged in, navigate to the ‘Cards’ section, select ‘Forex Cards,’ and then ‘View Balance.’ You will be able to access your real-time balance information instantly.

- Missed Call Service: Take advantage of ICICI Bank’s missed call service for a quick and effortless way to check your Forex Card balance. Simply dial the dedicated number, 9595957777, from the registered mobile number linked to your card. Your balance information will be provided through an SMS within seconds.

- Customer Care: If you encounter any difficulties with the methods above, don’t hesitate to connect with ICICI Bank’s dedicated Forex Card customer care team. Dial +91 22 4091 4091 from India or +91 22 6196 4091 from abroad and follow the instructions to get your account balance information.

Tips and Expert Advice for Managing Your ICICI Forex Card Wisely

To make the most of your ICICI Forex Card and avoid any potential pitfalls, here are some valuable tips:

- Monitor Transactions Regularly: Keep a close eye on your Forex Card transactions to track your expenses and avoid any fraudulent activities. Log in to your ICICI Bank account or use the ICICI Mobile Banking app to access your transaction history.

- Secure Your PIN: Your PIN is the key to protecting your Forex Card from unauthorized access. Memorize your PIN and never share it with anyone. If you forget your PIN, you can reset it by calling ICICI Bank’s customer care or visiting the nearest ICICI Bank branch.

- Avoid Dynamic Currency Conversion: DCC offers the convenience of paying in your home currency while using your Forex Card abroad. However, it may result in higher exchange rates and additional fees. To avoid these, always opt to pay in the local currency whenever possible.

FAQ: Unveiling the Mysteries of ICICI Forex Cards

A: An ICICI Forex Card is a prepaid travel card that allows you to carry and use various currencies conveniently while traveling abroad. ICICI Forex Card offers the advantage of locking in the exchange rate at the time of purchase, providing protection against currency fluctuations.

Q: How do I apply for an ICICI Forex Card?

A: Applying for an ICICI Forex Card is easy. You can apply online through ICICI Bank’s website or mobile application or visit your nearest ICICI Bank branch with the required documents.

Q: Are there any fees associated with using an ICICI Forex Card?

A: Yes, there may be certain fees associated with using an ICICI Forex Card, such as a card issuance fee, currency conversion fee, and ATM withdrawal fee. It is advisable to check with ICICI Bank for the exact fee structure.

Q: What is the limit on the amount I can load onto my ICICI Forex Card?

A: The maximum amount you can load onto your ICICI Forex Card depends on the type of card you have and your KYC status with ICICI Bank. It is generally within the limits prescribed by the Reserve Bank of India.

Q: Can I use my ICICI Forex Card for online purchases?

A: Yes, you can use your ICICI Forex Card for online purchases in foreign currencies. The amount will be deducted from your Forex Card balance, and you will benefit from the prevailing exchange rate.

Q: What should I do if my ICICI Forex Card is lost or stolen?

A: If your ICICI Forex Card is lost or stolen, it is crucial to report it immediately to ICICI Bank’s customer care. The bank will block the card to prevent unauthorized usage, and you can request a replacement card.

Image: www.bankindia.org

Check Icici Forex Card Balance

Conclusion: Empowering Your Travels with ICICI Forex Card Convenience

An ICICI Forex Card is an invaluable tool for travelers seeking a safe and convenient way to manage their finances while exploring the world. Checking your ICICI Forex Card balance is a quick and straightforward process, empowering you to stay informed about your spending and make informed decisions. By following the tips provided in this article, you can maximize the benefits of your ICICI Forex Card and enjoy your travels without any financial worries. Embrace the convenience and peace of mind that comes with using the ICICI Forex Card, and unlock the freedom to explore the world with confidence.

We hope this comprehensive guide has provided you with all the information you need to check your ICICI Forex Card balance effortlessly. If you have any further inquiries or require additional assistance, please feel free to reach out to ICICI Bank’s dedicated customer care team. With the ICICI Forex Card as your trusted financial companion, you can focus on creating unforgettable travel memories without the hassle of money management.

Are you ready to embark on your next adventure with the power of the ICICI Forex Card? Visit your nearest ICICI Bank branch or apply online today to experience the unparalleled convenience and financial freedom it offers.