In the fast-paced world of forex trading, understanding the intricacies of bid and ask prices is paramount to making informed decisions that can potentially yield profitable outcomes. Join us as we embark on an enlightening journey through this essential aspect of forex, empowering you with the knowledge and insights necessary to navigate the financial markets with confidence.

Image: www.thestreet.com

Bid and Ask: A Tale of Two Prices

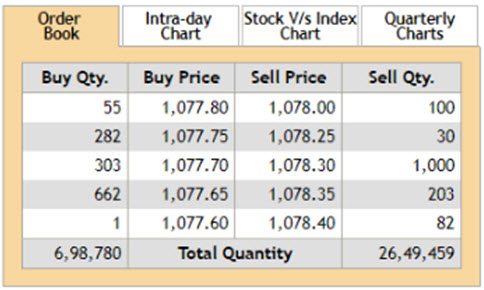

Simply put, the bid price is the price at which you can sell a currency, while the ask price is the price at which you can buy it. This delicate balance represents the constant interplay between buyers and sellers, with the bid price forming the floor and the ask price forming the ceiling of potential transactions.

Currency Pairs and Quoting Conventions

Forex trades involve the exchange of one currency for another, known as a currency pair. These pairs are always quoted in a specific order, for instance, EUR/USD or GBP/JPY. The first currency is the base currency, while the second is the quote currency.

The bid and ask prices for a currency pair are typically quoted in pips. A pip represents the smallest increment of price movement for a currency pair and is usually the fourth decimal place. For instance, if the EUR/USD bid price is 1.1056 and the ask price is 1.1057, the spread between the two is 1 pip.

Factors Influencing Bid and Ask Prices

A myriad of factors can influence bid and ask prices, including:

- Market sentiment: The overall sentiment among traders towards a particular currency, driving buying or selling pressure.

- Economic indicators: Data releases, such as GDP figures or inflation rates, can have significant impacts on currency values.

- Interest rates: Changes in interest rates set by central banks can affect the attractiveness of a currency.

- Political and geopolitical events: Significant events, such as elections or conflicts, can create volatility in currency markets.

Navigating Bid-Ask Spreads

The difference between the bid and ask prices is known as the spread. It represents the profit margin for market makers or brokers who facilitate trades. Spreads can vary depending on several factors, including currency pair, market conditions, and account types.

Impact of Bid-Ask Prices on Forex Trading

Understanding bid and ask prices is crucial for successful forex trading. They determine the potential profit or loss you might incur when entering or exiting a trade. A trader must always consider the spread when calculating potential returns.

Expert Insights and Actionable Tips

- Monitor economic data: Stay up-to-date with key economic news and indicators that can impact currency values.

- Adopt a disciplined trading strategy: Develop a clear plan outlining your trading approach, risk management, and profit targets.

- Use limit orders: Limit orders allow you to specify the exact price at which you want to buy or sell a currency pair, helping you avoid unfavorable prices.

- Leverage technology: Sophisticated trading platforms provide real-time updates and tools to analyze market trends and make informed decisions.

Conclusion

Unveiling the intricacies of bid and ask prices is an essential step towards becoming a confident and successful forex trader. By comprehending the interplay between these prices and the factors influencing them, you equip yourself with the knowledge to make enlightened trading decisions. Remember, the forex market presents both opportunities and challenges; armed with the right information and strategies, you can navigate its complexities and potentially reap its rewards.

Image: www.educba.com

Bid Price Vs Ask Price Forex