Introduction

In the dynamic world of forex trading, analytical tools play a crucial role in deciphering market trends and making informed decisions. Among these indispensable resources, the 4-hour candle stands as an invaluable instrument for traders seeking to maximize their returns. This comprehensive article delves into the captivating world of the 4-hour candle, exploring its intricacies, practical applications, and the benefits it offers traders in the ever-evolving forex market.

Image: www.forexfactory.com

Unveiling the 4-Hour Candle: A Powerful Analytical Tool

A 4-hour candle, as the name suggests, represents the price action of a currency pair over a four-hour period. It is a graphical representation that encapsulates the open, high, low, and close prices of a particular currency pair within that four-hour timeframe. This concise portrayal of price fluctuations offers traders a holistic view of market movements, facilitating astute decision-making.

Benefits of the 4-Hour Candle for Forex Traders

The 4-hour candle has gained immense popularity among forex traders due to its myriad advantages:

- Trend Identification: The 4-hour candle provides a clear visual representation of price trends. By analyzing the formation and patterns of these candles, traders can gauge the overall direction of the market, identifying potential trading opportunities.

- Support and Resistance Levels: Candlesticks often form at critical price levels, acting as support or resistance zones. The 4-hour candle helps traders identify these levels, enabling them to establish strategic trading strategies based on price movements and potential reversals.

- False Breakout Detection: The 4-hour candle helps traders differentiate between genuine breakouts and false breakouts. By observing candle formations and price action within the four-hour timeframe, traders can reduce the risk of falling prey to false signals and make more informed trading decisions.

- Enhanced Risk Management: The 4-hour candle facilitates robust risk management strategies. By analyzing candle patterns and price movements, traders can establish appropriate stop-loss and take-profit levels, protecting their capital while maximizing profit potential.

Practical Applications of the 4-Hour Candle

In real-world forex trading, the 4-hour candle has proven to be an invaluable tool:

- Trend Trading: Traders can identify sustained trends by analyzing consecutive 4-hour candles. Buying during an uptrend and selling during a downtrend, based on candle patterns and market momentum, can yield significant returns.

- Range Trading: When prices oscillate within a specific range, the 4-hour candle helps traders identify potential breakouts or continuations. By determining the range boundaries and monitoring candle formations, traders can capitalize on range-bound trading opportunities.

- Scalping: Scalping, a high-frequency trading strategy, leverages the short-term price fluctuations depicted by the 4-hour candle. Traders enter and exit positions within the four-hour timeframe, aiming for small but frequent profits.

A Closer Look at 4-Hour Candle Patterns

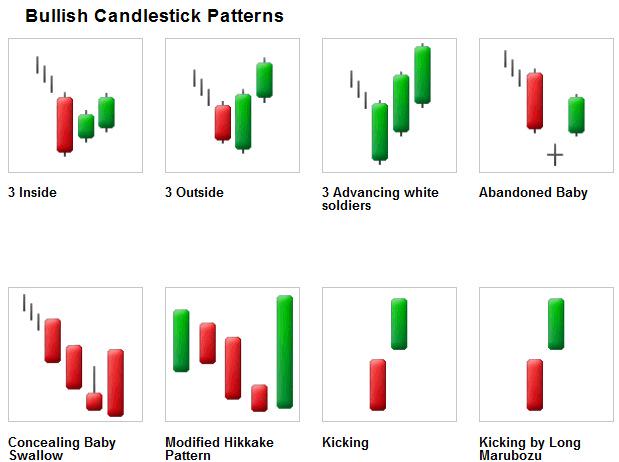

The 4-hour candle offers a wide range of patterns, each providing valuable insights into market behavior:

- Bullish Patterns: Bullish patterns, such as the hammer, inverted hammer, and engulfing patterns, indicate potential price increases. Traders often buy at the open below the candle low and place protective stops below the pattern’s low.

- Bearish Patterns: Bearish patterns, such as the shooting star, hanging man, and tweezer tops, suggest potential price declines. Traders may sell at the open above the candle high and set stop-losses above the pattern’s high.

- Neutral Patterns: Neutral patterns, such as the doji and spinning top

Image: mungfali.com

4 Hour Candle Times Forex

https://youtube.com/watch?v=LDLeYT4Y6rA