In the dynamic and fast-evolving world of foreign exchange, the USD/JPY currency pair remains in focus as it navigates a complex landscape of global economic headwinds.

Image: forexeageneratorcrackdownload.blogspot.com

USD/JPY: A Tale of Two Economies

The performance of USD/JPY is heavily influenced by the economic fundamentals of both the United States and Japan. While the US economy is grappling with persistent inflation and aggressive interest rate hikes by the Federal Reserve, Japan presents a starkly different picture characterized by anemic economic growth and unwavering monetary easing by the Bank of Japan.

Geopolitical Forces and Market Sentiment

In addition to economic factors, geopolitical tensions and investor sentiment play a significant role in shaping USD/JPY dynamics. Ongoing uncertainties surrounding the Russia-Ukraine conflict, escalating geopolitical risks in the Asia-Pacific region, and heightened volatility in global markets can all impact the pair’s trajectory.

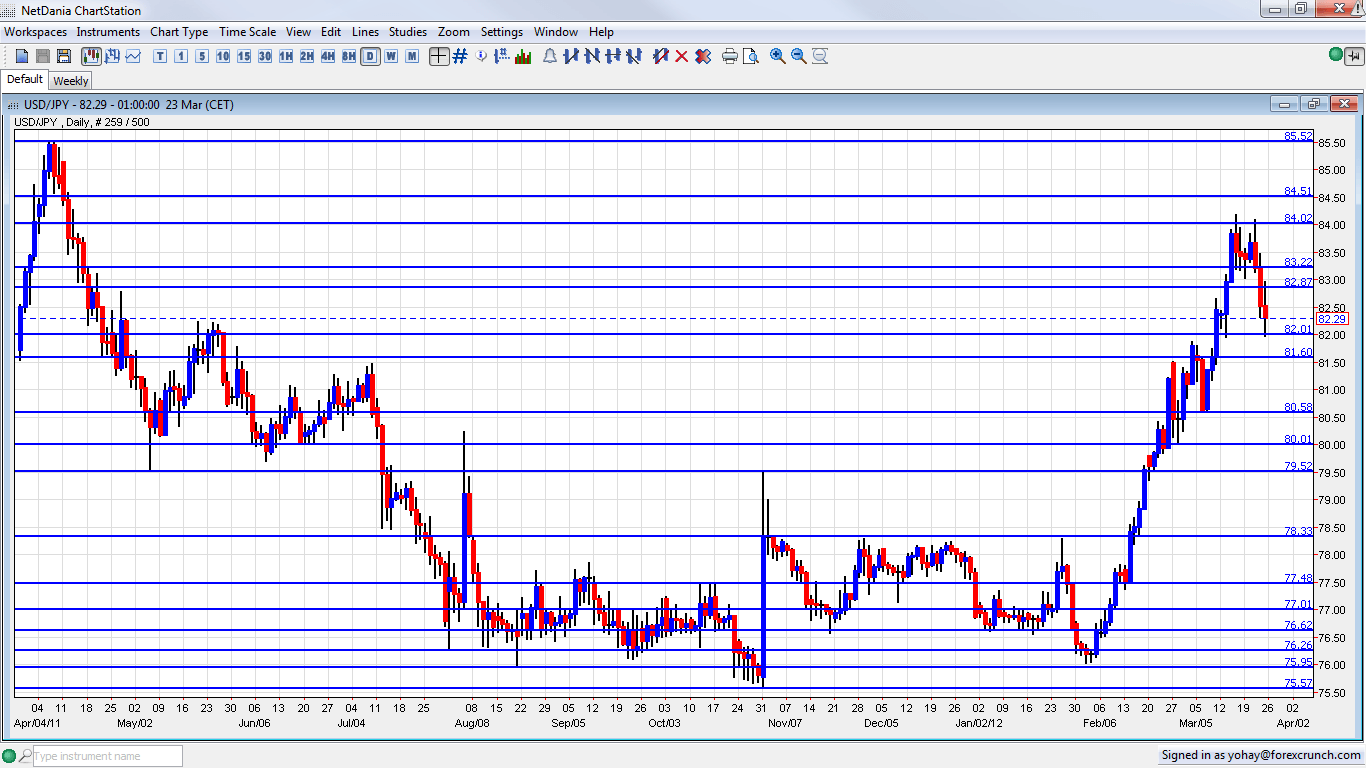

Technical Analysis and Market Structure

From a technical analysis perspective, USD/JPY recently broke below a key support level at 130, signaling potential weakness in the pair. However, it subsequently retraced and is now trading above this level. The pair is currently facing resistance at 133, and a breakout above this level could indicate a resumption of the uptrend.

Image: forexultrascalper20.blogspot.com

Expert Insights and Trading Strategies

Expert analysts recommend keeping a close watch on the latest economic data, geopolitical developments, and market sentiment when trading USD/JPY. They suggest adopting a risk-management approach, using stop-loss orders to limit potential losses, and exploiting opportunities for profit-taking when volatility subsides.

FAQ on USD/JPY

Q: What factors influence USD/JPY?

A: Economic fundamentals of the US and Japan, geopolitical factors, and market sentiment.

Q: What is the current technical outlook for USD/JPY?

A: Trading above support at 130, facing resistance at 133.

Q: What trading strategies can I use?

A: Adopt a risk-management approach, use stop-loss orders, and capitalize on opportunities for profit-taking.

Usd Jpy Forex News Today

Conclusion: Engaging with the Market

USD/JPY remains a highly dynamic currency pair, offering both opportunities and challenges for traders. By staying informed about economic news, market events, and technical analysis, and by implementing a prudent trading strategy, investors can navigate the evolving forex landscape and potentially reap rewards.

Are you interested in learning more about USD/JPY forex news? Share your thoughts and engage with the community in the comments section below.