In the ever-evolving landscape of forex trading, discerning traders seek every edge to navigate market volatility and seize profitable opportunities. Among the myriad technical analysis tools at their disposal, point and figure charts (PFCs) stand out as a unique and powerful tool that can empower traders with actionable insights. Embark on a journey to unravel the intricacies of point and figure charts, and discover how they can enhance your forex trading prowess.

Image: forums.forex-strategies-revealed.com

Unveiling the Essence of Point and Figure Charts: A Crucible of Meaning in Market Action

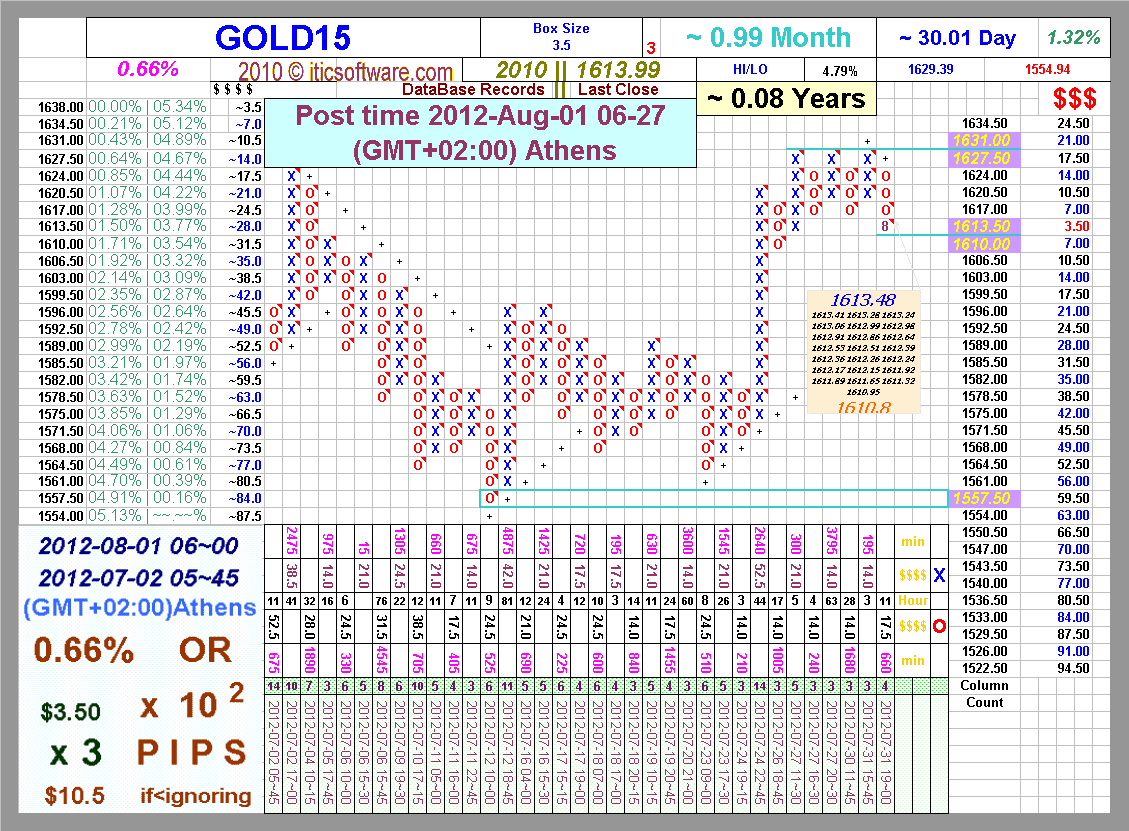

Distinct from traditional candlestick or bar charts, point and figure charts transcend time and volume, focusing solely on price action, the essential lifeblood of any market. They present a stripped-down representation of market movements, where a column of Xs (in blue) signifies rising prices, while a column of Os (in red) chronicles price declines. This minimalistic approach eliminates noise and clutter, enabling traders to discern underlying trends with remarkable clarity.

Delving into the Construction: Distilling Meaning from Market Motion

The construction of point and figure charts hinges on two fundamental parameters: box size and reversal amount. Box size establishes the minimum price movement required to create a new column, while reversal amount determines the threshold for changing from an X column to an O column (or vice versa), ensuring integrity and consistency in trend identification.

Decoding the Secrets: Extracting Actionable Insights

Point and figure charts, despite their simplicity, yield a wealth of valuable information for astute traders. Columns of Xs signify bullish momentum, indicating a potential uptrend, while columns of Os suggest bearish sentiment, heralding a potential downtrend. The number of Xs or Os in a column measures the strength of the trend, enabling traders to gauge market sentiment. Additionally, breakouts from significant support or resistance levels, represented by areas of dense X or O columns, provide powerful trading signals.

Image: theforexgeek.com

The Power of Point and Figure Charts: Ascending to Trading Mastery

Point and figure charts transcend their simplicity, offering traders an arsenal of advantages that can elevate their trading prowess:

-

Unveiling Hidden Trends:

PFCs strip away market noise, unveiling underlying trends that may be obscured in traditional charts.

-

Unwavering Objectivity:

By relying solely on price action, PFCs eliminate subjective interpretations, providing a pure and bias-free representation of market dynamics.

-

Early Trend Identification:

PFCs excel at identifying trends in their early stages, empowering traders to position themselves ahead of the market’s dominant momentum.

-

Risk Management Partner:

PFCs facilitate effective risk management by highlighting potential support and resistance levels, enabling traders to set appropriate stop-loss and take-profit orders.

Point And Figure Chart Forex

Conclusion: Demystifying Market Complexity with Point and Figure Charts

In the fast-paced and complex world of forex trading, point and figure charts emerge as an indispensable tool for discerning traders. Their ability to filter noise, reveal trends, and provide objective signals empowers traders to make informed decisions that can lead to consistent profitability. Embrace the transformative power of point and figure charts, and embark on a trading journey where clarity and precision guide your every move.