The adrenaline-pumping world of Forex trading offers a plethora of opportunities to both novice and experienced traders. However, navigating the intricate landscape of forex requires a deep understanding of the tools and concepts that govern it. One such concept is leverage, a significant factor that can influence your trading strategies and potential returns. In this article, we’ll delve into the intricacies of high leverage in forex trading, exploring its advantages and potential pitfalls to help you make informed decisions.

Image: www.forextrading.ng

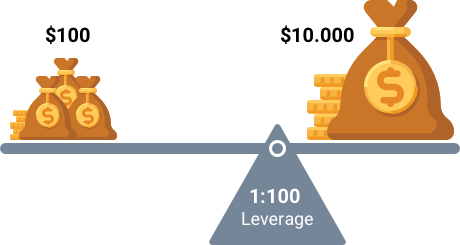

Leverage, in essence, allows traders to magnify their trading power by borrowing funds from their broker. This borrowed capital enables traders to control a larger position size than their actual account balance would permit. For instance, if you have a $1,000 account balance and trade with 100:1 leverage, you can potentially control a $100,000 position. While this may seem like an attractive proposition, it’s crucial to understand the inherent risks involved.

**Benefits of High Leverage in Forex Trading**

- Increased Trading Power: Leverage amplifies your buying power, allowing you to trade larger positions with a relatively small account balance.

- Potential for Higher Returns: With increased trading power, you have the potential to generate higher profits if the market moves in your favor.

- Enhanced Flexibility: Leverage provides greater flexibility in your trading strategies, enabling you to capitalize on both short-term and long-term market opportunities.

**Understanding the Risks of High Leverage**

While high leverage can offer tempting advantages, it’s essential to be aware of the accompanying risks:

- Magnified Losses: Just as leverage can amplify your profits, it can also magnify your losses. If the market moves against your position, your losses can exceed your account balance, potentially leading to a margin call and forced liquidation of your assets.

- Increased Margin Calls: Traders using high leverage are more susceptible to margin calls, which occur when your account balance falls below a certain level. Failure to meet a margin call can result in the closure of your positions.

- Emotional Trading: High leverage can lead to emotional trading, as traders may feel pressured to make quick decisions to avoid large losses. This can result in poor decision-making and compromised risk management.

**Tips for Using High Leverage Prudently**

If you decide to use high leverage, it’s crucial to follow these expert tips:

- Start Small: Begin with a modest leverage ratio and gradually increase it as you gain experience and confidence.

- Manage Risk Wisely: Implement a robust risk management strategy, including stop-loss orders, position sizing, and hedging techniques.

- Control Emotions: Stay disciplined and avoid letting emotions dictate your trading decisions. Stick to your trading plan and don’t overtrade.

- Train and Educate: Continuously educate yourself about forex trading and leverage to enhance your understanding and decision-making abilities.

Image: www.ifcmarkets.com

**FAQs on High Leverage in Forex Trading**

Q: What is the optimal leverage ratio for forex trading?

A: The optimal leverage ratio varies depending on your risk tolerance, trading style, and account balance. It’s recommended to start with a conservative leverage ratio and increase it gradually based on your experience.

Q: Can I lose more money than my account balance using high leverage?

A: Yes, with high leverage, you can lose more money than your account balance if the market moves against your position. This is known as a margin call.

Q: Is high leverage suitable for beginners?

A: High leverage is not recommended for beginners due to the increased risk involved. It’s essential to gain experience and a sound understanding of forex trading before using high leverage.

Is High Leverage Good In Forex Trading

**Conclusion**

High leverage in forex trading can offer potential benefits, including increased trading power and enhanced flexibility. However, it’s crucial to thoroughly understand the associated risks before employing high leverage in your trading strategies. By following the tips outlined above, controlling emotions, and implementing sound risk management practices, you can mitigate the risks and harness the potential rewards of high leverage trading.

Are you ready to explore the dynamic world of high leverage forex trading? Let us know your thoughts or questions in the comments section below.