In the ever-complex realm of global finance, businesses navigate the turbulent waters of currency fluctuations. These fluctuations, often referred to as foreign exchange (forex) gains or losses, can significantly impact financial statements and overall profitability. One particular aspect that perplexes many is the enigmatic concept of unadjusted forex gain loss. In this comprehensive guide, we will unravel this enigma, empower you with the knowledge to identify and address it, and unveil the intricacies of its removal.

Image: help.tallysolutions.com

What is Unadjusted Forex Gain Loss?

Unadjusted forex gain loss, simply put, is a temporary and unrealized difference in the value of a company’s assets or liabilities denominated in foreign currencies. It arises when the functional currency of a company, which is the primary currency used in its financial reporting, differs from the currencies in which its transactions are conducted. When the value of the functional currency strengthens relative to foreign currencies, an unadjusted forex gain is recognized, while a weakening of the functional currency leads to an unadjusted forex loss.

The Importance of Addressing Unadjusted Forex Gain Loss

While unadjusted forex gain loss is considered temporary, its presence can distort a company’s financial performance. Overstated gains can inflate profitability, while understated losses can conceal actual financial weakness. For investors and analysts, unadjusted forex gain loss can make it challenging to accurately assess a company’s underlying financial health.

Strategies for Removing Unadjusted Forex Gain Loss

The removal of unadjusted forex gain loss is essential for presenting a clear and accurate picture of a company’s financial performance. There are two primary strategies to achieve this:

-

Transaction-Based Exposure Management: This strategy involves implementing mechanisms to mitigate the impact of currency fluctuations on individual transactions. Hedging instruments such as forward contracts, options, and currency swaps can be used to lock in exchange rates at the time of the transaction, effectively eliminating unadjusted forex gain loss.

-

Translation-Based Exposure Management: This strategy focuses on adjusting the financial statements to reflect the current exchange rates at the time of translation. This involves restating assets, liabilities, and equity in the functional currency using the prevailing exchange rates, resulting in the removal of unadjusted forex gain loss.

Image: www.tradingview.com

Expert Insights:

“Unadjusted forex gain loss can be a significant factor in financial reporting, and its removal is crucial for transparent and reliable financial statements,” emphasizes Dr. Emily Carter, a seasoned finance professor. “Transaction-based exposure management is a proactive approach that can effectively mitigate currency fluctuations, while translation-based exposure management ensures a more accurate representation of a company’s financial performance.”

Actionable Tips:

- Regularly monitor your company’s exposure to foreign currencies and identify potential sources of unadjusted forex gain loss.

- Implement robust hedging strategies to minimize currency risk on individual transactions.

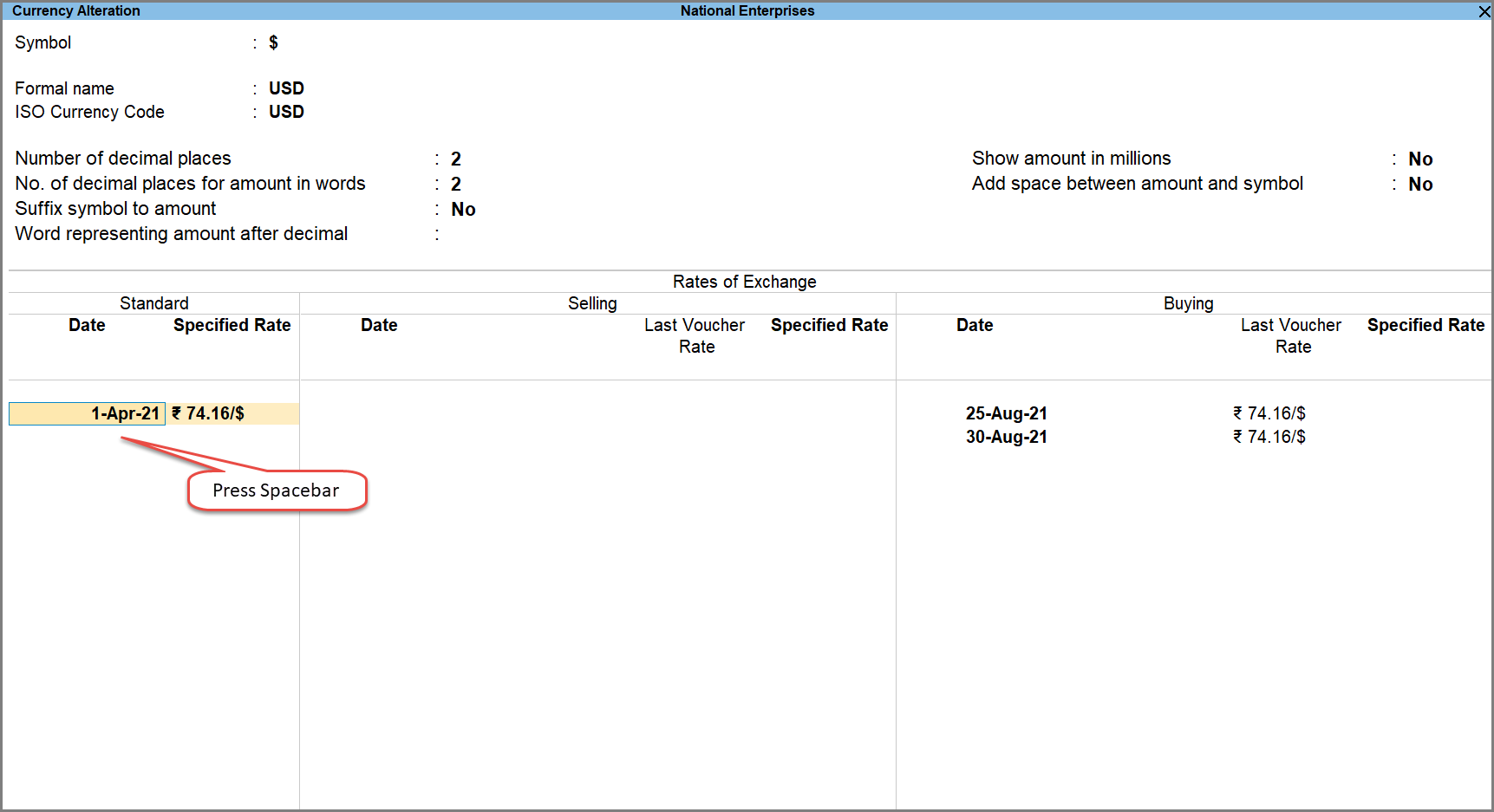

- Consider using accounting software that supports translation-based exposure management to streamline the process of removing unadjusted forex gain loss.

- Seek professional guidance from financial experts to ensure compliance with accounting standards and best practices.

How To Remove Unadjusted Forex Gain Loss

Conclusion

Unadjusted forex gain loss, while temporary, can significantly impact financial reporting and distort a company’s financial performance. By understanding its nature and implementing effective removal strategies, businesses can present a clear and accurate picture of their financial health. Transaction-based exposure management and translation-based exposure management offer practical solutions to neutralize the effects of currency fluctuations, empowering decision-makers with unbiased and reliable financial information.