As an ardent traveler, the prospect of venturing abroad ignites a thrilling surge of anticipation. Yet, among the myriad preparations, safeguarding your finances should be paramount. Amidst the plethora of options, ICICI’s Forex Card emerges as a secure and convenient solution. However, unlocking its full potential hinges upon its seamless activation. In this comprehensive guide, we delve into the intricacies of ICICI Forex Card activation, empowering you with the knowledge and confidence to navigate this process effortlessly.

Image: abroadcube.com

Unveiling the ICICI Forex Card

An ICICI Forex Card is an indispensable financial tool for discerning travelers. It bestows upon you the freedom to transact in over 200 countries and territories, shielding you from the fluctuations and complexities of foreign exchange markets. With its multi-currency functionality, you can seamlessly switch between major global currencies, eliminating the need for multiple cards or exorbitant exchange fees.

A Step-by-Step Activation Journey

Activating your ICICI Forex Card is a straightforward process designed to ensure your financial well-being on foreign shores. Let’s embark on this journey with a step-by-step approach:

-

Retrieve Your Forex Card at Your Nearest ICICI Branch:

Initiate the activation process by visiting your designated ICICI branch with your government-issued identity proof, such as your passport. -

Request Activation from Customer Care:

Contact the dedicated customer care number or visit the official ICICI website to request activation. You’ll be prompted to verify your personal details and provide the 16-digit card number. -

Set Your Personal PIN:

Once your card is activated, it’s imperative to set a secure PIN. You can do this by calling customer care or visiting an ICICI ATM.

Expert Insights and Essential Tips

To maximize the utility of your ICICI Forex Card, consider these expert insights:

-

Monitor Your Balance Regularly: Keep track of your expenditures through the ICICI net banking portal or mobile application to avoid overspending and potential debt.

-

Utilize SMS Alerts: Opt for SMS alerts to receive updates on transactions and card usage, providing you with real-time peace of mind.

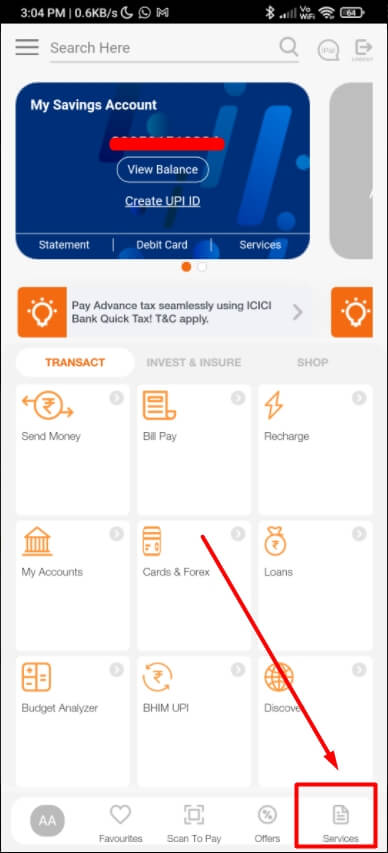

Image: thebankhelp.com

How To Activate Forex Card Icici

Conclusion

Activating your ICICI Forex Card is a crucial step towards securing your financial footing during international travel. By following the detailed instructions provided and leveraging expert tips, you can unlock the boundless benefits of this versatile financial instrument. Embrace the freedom and convenience of cashless transactions, eliminate currency conversion hassles, and embark on your global adventures with confidence. Remember, your ICICI Forex Card is more than just a payment tool; it’s the key to unlocking the world, one transaction at a time.