Unveiling the Forex Currency Index Indicator: A Guiding Star for Traders

Image: bichafeds.blogspot.com

In the labyrinthine world of currency trading, the Forex Currency Index Indicator (FXCI) emerges as a beacon of guidance, illuminating the path towards informed and profitable decisions. This article will delve into the depths of FXCI, exploring its history, intricacies, and unparalleled value to traders.

Definition and Significance of FXCI

The Forex Currency Index Indicator is a comprehensive measure of the value of a currency against a basket of other currencies. It provides a holistic view of currency performance, offering insights into global economic trends and investment opportunities. By tracking the movements of multiple currencies simultaneously, FXCI enables traders to identify potential risks and allocate funds wisely.

Historical Roots and Applications

The concept of a currency index dates back to the late 1970s, when the U.S. dollar’s dominance waned. The need for a more comprehensive measure of currency value led to the creation of FXCI, which was initially calculated as a weighted average of the value of the U.S. dollar against the currencies of the ten most developed economies. Over the years, the composition of FXCI has evolved to reflect shifts in global economic power.

Benefits of Using FXCI

FXCI offers a multitude of benefits for forex traders:

- Enhanced Risk Management: Monitoring FXCI can help traders identify potential shifts in currency values, enabling them to implement appropriate risk-management strategies.

- Informed Investment Decisions: FXCI provides valuable insights into global economic trends, informing traders’ decisions on which currencies to buy or sell.

- Technical Analysis Simplification: By tracking the movement of a currency against a basket of others, FXCI simplifies technical analysis and makes trade identification easier.

- Diversification Opportunities: FXCI helps traders diversify their portfolios by identifying undervalued currencies that may offer growth potential.

Deep Dive into FXCI Calculations

FXCI is calculated using a weighted average of the value of a currency against a basket of other currencies. The weight assigned to each currency reflects its importance in global trade and economic activity. The most common currencies included in FXCI are the U.S. dollar (USD), Euro (EUR), Japanese Yen (JPY), British Pound (GBP), and Swiss Franc (CHF).

Expert Insights and Actionable Tips

Seasoned forex traders offer invaluable insights into utilizing FXCI:

- Peter Brant: “FXCI can act as a barometer of global sentiment, providing valuable insights into market trends and risk appetite.”

- Joe Ross: “By monitoring FXCI divergence from other indicators, traders can identify potential trading opportunities early on.”

- Anna Coulling: “Trading FXCI can be a profitable strategy when paired with sound technical analysis and risk-management practices.”

Conclusion

The Forex Currency Index Indicator is an indispensable tool for forex traders seeking to unlock the secrets of currency markets. By providing a comprehensive view of currency value and market trends, FXCI empowers traders to make informed decisions, manage risk, and seize investment opportunities. Embrace the power of FXCI and elevate your trading strategy to new heights.

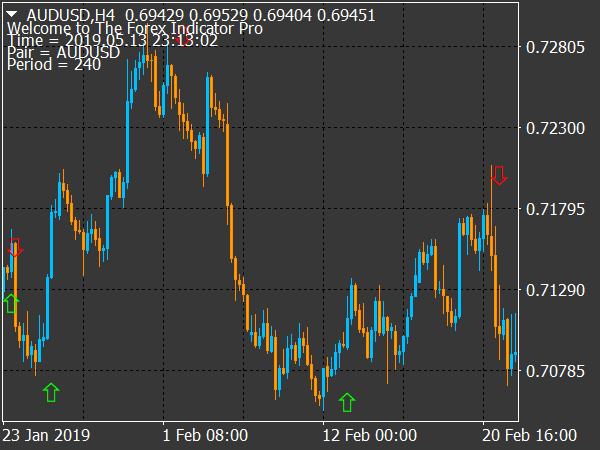

Image: www.best-metatrader-indicators.com

Forex Currency Index Indicator Mt4