Forex Exchange Market Unveiled

The forex market, an ever-evolving and intricate realm of global currency trading, serves as the lifeblood of international finance. Understanding the dynamics that drive this colossal market is vital for traders seeking success in this vast ocean of currencies. One such invaluable tool is the Commitment of Traders (COT) report, an indispensable weapon in the arsenal of serious forex traders.

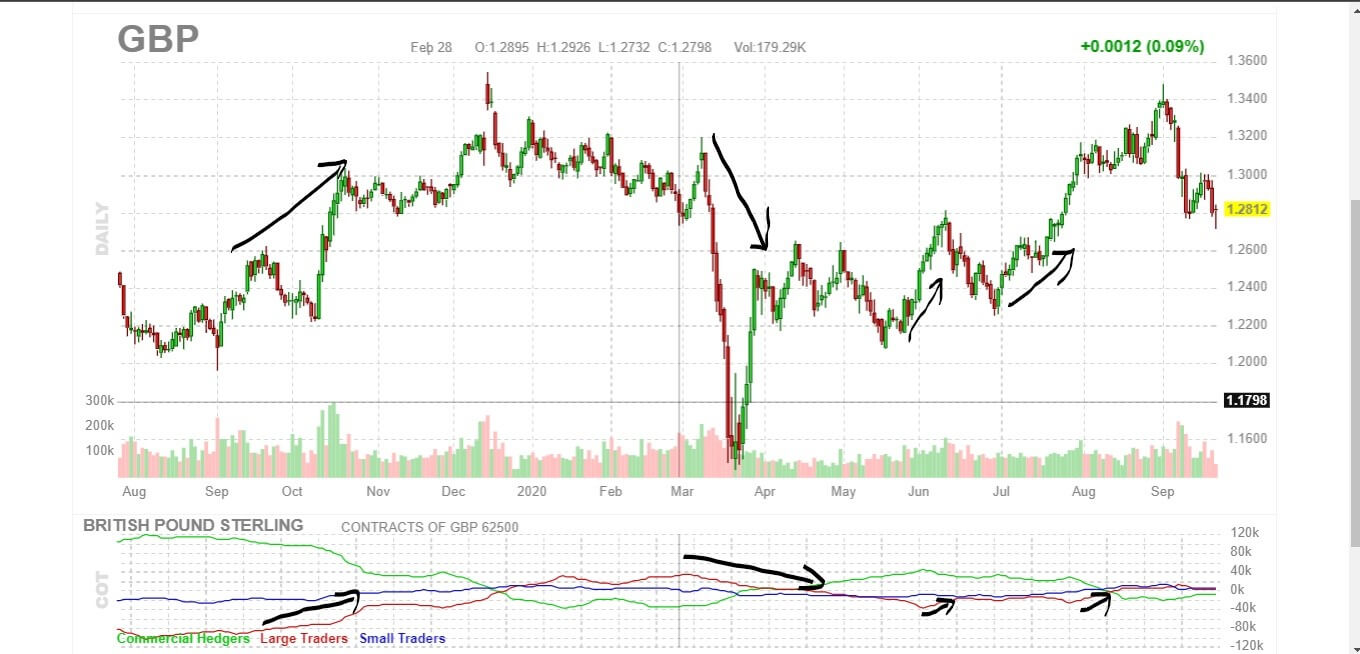

Image: www.forex.academy

What’s in a COT Report?

The COT report, meticulously compiled by regulatory bodies such as the Commodity Futures Trading Commission (CFTC), provides a granular snapshot into the positioning of major market participants, revealing their speculative stances on various currency pairs. This confidential information, poised to enlighten us about the collective wisdom of market heavyweights, has been judiciously unearthed through mandatory reporting requirements. From seasoned veterans like commercial hedgers to speculators betting on price fluctuations, the COT report casts light upon the strategies and predilections that shape the direction of the market.

Unleash the Power of COT Data

Dissecting the COT report unlocks a wealth of insights for savvy forex traders. By analyzing the net speculative positions of various market players, discerning traders can deduce probable shifts in market sentiment and the potential trajectory of currency pairs. This invaluable intelligence empowers traders to make informed decisions, augmenting their chances of successful market navigation and profitability.

Decoding the COT Report: Trading Gems

The COT report, while a treasure trove of information, requires adept interpretation to unveil its hidden gems. Scrutinize the net speculative positions of futures contracts to deduce the collective bias of speculators, whether they foresee currency appreciation or depreciation. Further, discerning traders keenly observe the changes in these positions over time, gaining invaluable insights into shifting market sentiment and potential price movements.

Image: www.dailyfx.com

COT Report in Action: Real-World Examples

Envision the instance when a COT report reveals a marked increase in speculative short positions held by large traders on the EUR/USD pair. This poignant observation might signal a brewing bearish sentiment, indicating that these market heavyweights believe the euro is poised to lose ground against the US dollar. Armed with this foresight, astute forex traders might consider adjusting their own positions accordingly, aligning them with the perceived market direction.

Limitations and Considerations

While the COT report proffers invaluable insights, it does possess certain limitations. The data is backward-looking, reflecting positions held at the time of the report’s publication. Moreover, the information provided is aggregated, obscuring the intentions of individual market participants. A prudent forex trader, cognizant of these limitations, will not repose blind faith in the COT report but rather incorporate it as one element within their comprehensive trading strategy.

Forex Commitment Of Traders Cot Report

Conclusion: Harnessing the COT Report

In the ever-evolving landscape of the forex market, the Commitment of Traders (COT) report stands as an invaluable resource for those seeking knowledge and empowerment. By deciphering the intricate details of this illuminating report, forex traders can gain a profound understanding of market sentiment, anticipate potential currency movements, and position themselves for potential profit. While it may not be a magic crystal ball, the COT report, astutely interpreted, can provide discerning traders with an edge, aiding them in navigating the turbulent waters of the forex market.