Introduction

In the globalized world of today, where international trade and travel are commonplace, it’s essential to understand currency exchange rates to facilitate seamless financial transactions. Axis Bank, one of India’s leading private sector banks, offers comprehensive foreign exchange services, including a meticulously maintained Forex rates chart. This chart serves as an invaluable tool for individuals and businesses alike, providing real-time updates on currency exchange rates and enabling informed financial decisions. In this comprehensive guide, we delve into the intricacies of the Axis Bank Forex rates chart, empowering you with the knowledge to navigate currency conversions with confidence.

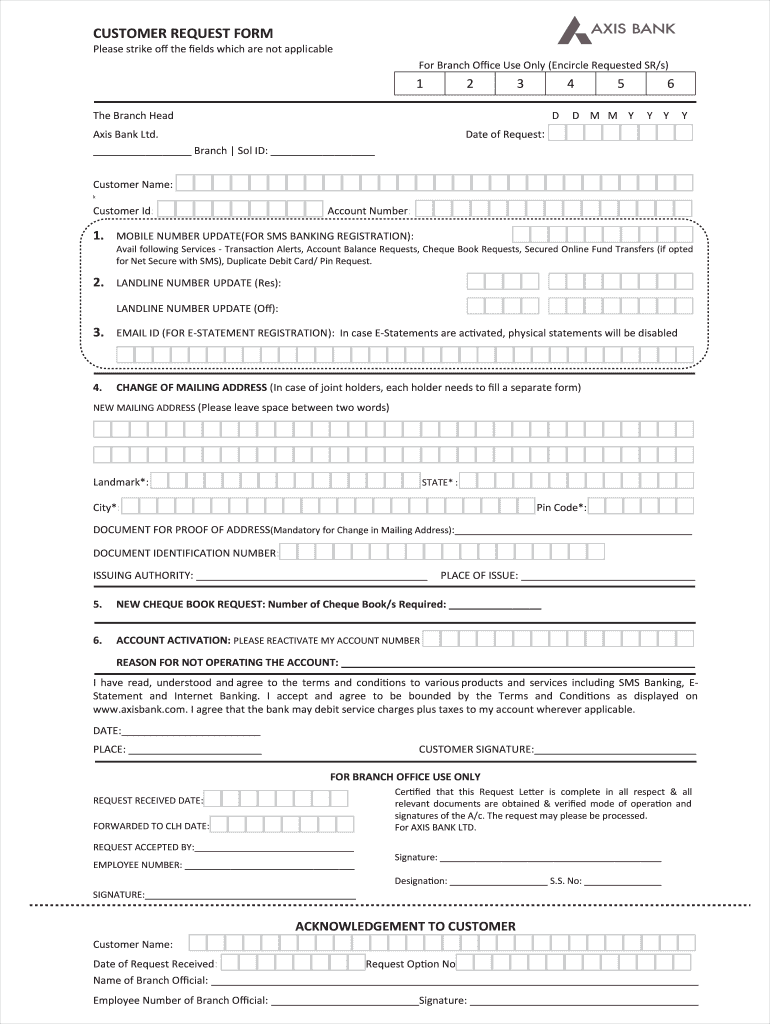

Image: lindencourtforexsystem.blogspot.com

Understanding the Forex Rates Chart

The Axis Bank Forex rates chart is a user-friendly interface that displays real-time exchange rates for various currency pairs. It encompasses a wide range of currencies, including major global currencies like the US dollar, Euro, and British pound, as well as emerging market currencies. The chart presents both buy and sell rates for each currency pair, allowing users to determine the most favorable exchange rate for their transactions.

Key Features and Benefits

- Real-Time Updates: The Axis Bank Forex rates chart is constantly updated to reflect the latest market conditions, ensuring access to the most up-to-date exchange rates.

- Comprehensive Currency Coverage: The chart encompasses a vast array of currencies, catering to the diverse needs of individuals and businesses engaged in international transactions.

- User-Friendly Interface: Designed with simplicity in mind, the chart presents information in a clear and concise manner, making it easy to navigate and understand.

- Invaluable for Informed Decisions: The Forex rates chart empowers users to make informed financial decisions by providing them with the necessary information to compare exchange rates and identify the most advantageous time to execute currency conversions.

- Risk Management: By closely monitoring the Forex rates chart, individuals and businesses can mitigate currency risks and make informed hedging decisions to protect their financial interests.

Factors Influencing Forex Rates

Forex rates are highly dynamic and influenced by a myriad of factors, including:

- Economic Conditions: The economic health of a country, including GDP growth, inflation, and interest rates, significantly impacts its currency’s value.

- Political Stability: Political uncertainty or instability can lead to currency volatility and depreciation.

- Interest Rate Differentials: Currencies with higher interest rates tend to appreciate against those with lower interest rates.

- Supply and Demand: Fluctuations in demand and supply for currencies based on trade flows and investments also influence exchange rates.

- Speculation: Forex traders and investors often speculate on currency movements, which can contribute to short-term volatility.

Image: forexsystemthatactuallyworks.blogspot.com

Tips for Using the Forex Rates Chart

- Regular Monitoring: Regularly track the Forex rates chart to stay abreast of currency fluctuations and identify favorable exchange rates.

- Compare Rates: Compare exchange rates from multiple sources, including Axis Bank and other banks, to secure the best possible deal.

- Consider Transaction Fees: Factor in any transaction fees or charges imposed by banks or money transfer services.

- Plan Transactions Wisely: Execute currency conversions when exchange rates are favorable to maximize value.

- Use Limit Orders: If desired, place limit orders with Axis Bank to automatically execute currency conversions at predetermined exchange rates.

Axis Bank Forex Rates Chart

Conclusion

The Axis Bank Forex rates chart is an indispensable tool that empowers individuals and businesses to confidently navigate the complexities of currency conversions. By harnessing the information provided on the chart, users can make informed financial decisions, protect against currency risks, and capitalize on favorable exchange rates. Stay updated with the latest market conditions by regularly monitoring the Forex rates chart and seize every opportunity to optimize your currency conversions.