In the dynamic world of forex trading, where market fluctuations can make or break fortunes, traders rely on a myriad of tools and techniques to navigate the turbulent waters. Among these tools, candlesticks stand out as a time-tested and invaluable technique that has consistently proven its effectiveness in deciphering market behavior and identifying potential trading opportunities.

Image: srading.com

Candlesticks are graphical representations of price movements over a specific time interval, typically a day, a week, or a month. They are composed of two main elements: a body (real) and a wick (shadow) that extend from the top and bottom of the body, indicating the price range within that time period. Each candlestick, with its unique shape and pattern, conveys a wealth of information about the market’s activity, providing traders with insights into the current market sentiment and potential future price movements.

Delving into the Diversity of Candlesticks

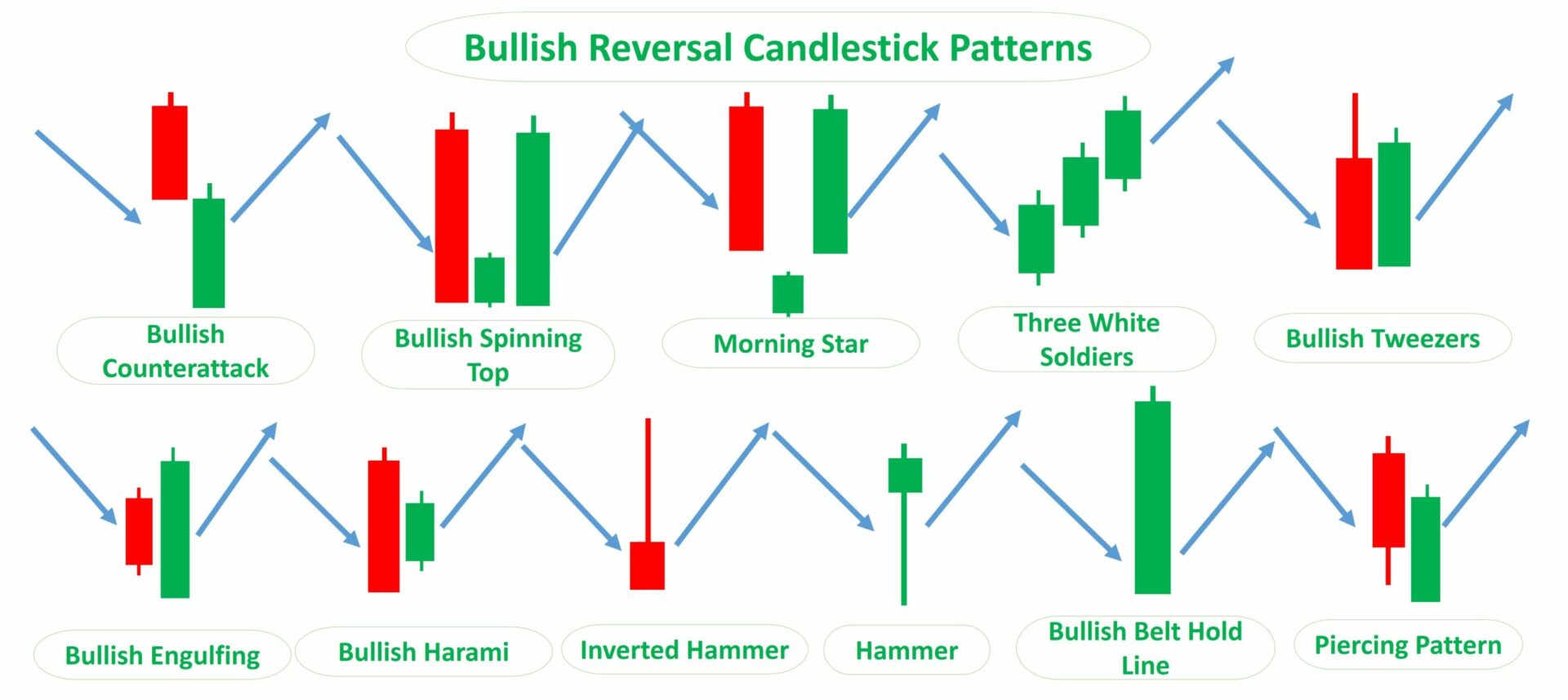

The world of candlesticks is a vast one, with an array of patterns, each bearing its own significance. Some of the most commonly encountered candlestick patterns include:

-

The Hammer: Resembling a hammer, this pattern starts with a downtrend, followed by a sharp surge, creating a long lower wick. Often considered a bullish signal, it suggests a possible trend reversal.

-

The Inverted Hammer: The mirror image of the Hammer, it starts with an uptrend followed by a sharp downturn, indicating a potential bearish reversal.

-

The Doji: Characterized by a cross or equal sign shape, it represents indecision in the market, where the opening and closing prices are nearly identical.

-

The Star: A Doji with long wicks extending both above and below the cross, the Star is a signal of intense volatility and uncertainty.

-

The Bullish Engulfing: This pattern occurs when a bearish candle is completely engulfed by a larger bullish candle, indicating a strong uptrend.

-

The Bearish Engulfing: The opposite of the Bullish Engulfing, where a bullish candle is engulfed by a bearish candle, signaling a bearish reversal.

-

The Morning Star: A three-candle pattern, it starts with a bearish candle, followed by a bullish candle that gaps above the previous candle’s high, and a third bullish candle that confirms the uptrend.

-

The Evening Star: The bearish counterpart of the Morning Star, it suggests a downtrend reversal.

Image: www.aiophotoz.com

Types Of Candle Sticks In Forex

https://youtube.com/watch?v=FQc4hKetzig

Candlesticks, a Compass in the Forex Maze

Candlestick patterns, when used in conjunction with other technical indicators, offer valuable guidance in navigating the intricate forex market. They can be instrumental in identifying entry and exit points, estimating risk and reward potential, and predicting future price direction.

However, it’s important to remember that while candlesticks are a powerful tool, they are not an infallible predictor of market behavior. They should be combined with a holistic understanding of the market, including economic data, news events, and geopolitical factors, to make informed trading decisions.

Embark on your forex trading journey with the illuminating power of candlesticks. Unlock the insights they hold to enhance your decision-making and seize the opportunities that the volatile forex market presents.