Unveiling the Transparency of the Financial World

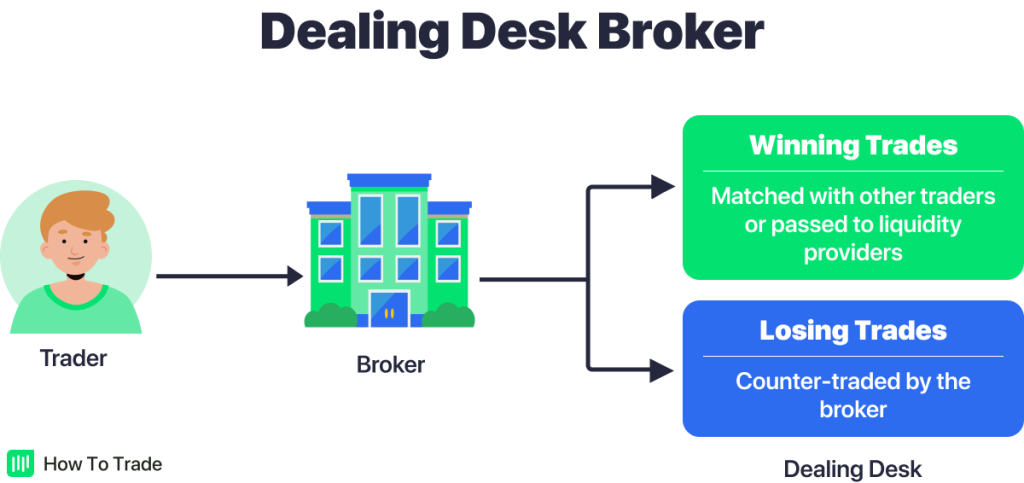

Have you ever wondered how currency traders make money? The answer lies in the world of forex brokers, the middlemen that connect traders to the global валютный рынок. Traditionally, dealing desk brokers acted as market makers, setting prices and profiting from the difference between the bid and ask prices (known as the spread). However, a new breed of brokers has emerged—non dealing desk (NDD) forex brokers—who are changing the game by offering greater transparency and potential benefits for traders.

Image: pipsedge.com

What is a Non Dealing Desk Forex Broker?

In contrast to dealing desk brokers, NDD forex brokers do not have a dealing desk that sets prices. Instead, they act as intermediaries, passing orders directly to liquidity providers (LPs), such as banks and major institutional traders. These LPs are the actual market makers, offering bid and ask prices based on real-time market conditions. By eliminating the dealing desk, NDD brokers remove the potential for conflicts of interest that can arise when the broker is also the counterparty to the trader’s trades.

Benefits of Trading with an NDD Broker

Trading with an NDD forex broker offers several advantages over dealing desk brokers:

-

True Market Prices: NDD brokers provide raw, unfiltered prices directly from LPs, ensuring traders get the best possible execution on their orders.

-

Reduced Spreads: By eliminating the dealing desk markup, NDD brokers offer narrower spreads, resulting in lower transaction costs for traders.

-

Transparency and Fairness: NDD brokers provide a transparent trading environment where conflicts of interest are minimized, fostering trust and confidence among traders.

-

Faster Execution: Orders executed directly to LPs are processed more efficiently, resulting in faster and more reliable trade execution.

-

Reduced Slippage: Since NDD brokers do not have a dealing desk that can interfere with order execution, slippage (the difference between the requested price and the actual executed price) is minimized.

Navigating the Non Dealing Desk Landscape

To make the most of your trading experience with an NDD forex broker, consider the following tips:

-

Research the Liquidity Providers: Choose an NDD broker that has partnerships with reputable LPs to ensure order execution is reliable and efficient.

-

Understand the Order Types: NDD brokers may offer different order types, such as market orders, limit orders, and stop orders. Familiarize yourself with these order types to optimize your trading strategy.

-

Monitor Slippage: While NDD brokers generally experience less slippage, it’s still essential to monitor slippage levels and adjust your trading strategy accordingly.

-

Consider Commission-Based Pricing: Some NDD brokers charge commission on each trade. Compare commission rates to ensure they align with your trading volume and style.

Image: howtotrade.com

FAQ on Non Dealing Desk Forex Brokers

Q: How do NDD brokers make money?

A: NDD brokers typically charge a commission on each trade or earn a rebate from the LPs they partner with.

Q: Are NDD brokers more reputable than dealing desk brokers?

A: Reputability depends on individual brokers and their business practices. However, NDD brokers generally offer greater transparency and reduced potential for conflicts of interest.

Q: What are the risks of trading with NDD brokers?

A: The risks of trading with NDD brokers are similar to trading with dealing desk brokers, including market volatility, leverage, and potential losses.

Non Dealing Desk Forex Brokers

Conclusion

Non dealing desk forex brokers have revolutionized currency trading, offering greater transparency, reduced costs, and a more equitable trading environment. By partnering directly with LPs, NDD brokers provide traders with raw market prices and fast order execution. If you value transparency, reduced spreads, and a level playing field, consider exploring the benefits of trading with an NDD forex broker.

Are you ready to delve into the world of non dealing desk forex brokers and discover the advantages they offer for your trading journey?