Unlock the Secrets to Enhanced Trading

Navigating the world of forex trading requires a deep understanding of the intricacies that drive market dynamics. Margin and free margin are two fundamental concepts that every trader must grasp to optimize their trading strategies. In this comprehensive guide, we will delve into the depths of these concepts, exploring their significance, latest trends, and expert tips to maximize your trading potential.

Image: taniforex.com

Understanding Margin and Free Margin

Margin refers to the deposit required by a broker to open and maintain a leveraged position. It serves as collateral, providing the trader with the ability to control a larger trading volume than their account balance. Free margin, on the other hand, represents the available balance in a trading account that can be used for additional trading or to cover losses.

Margin trading magnifies both profits and losses. While it increases the potential returns, it also amplifies the risks associated with trading. Therefore, it is crucial to determine the appropriate leverage ratio based on individual risk tolerance and trading strategy.

Leverage and Its Impact

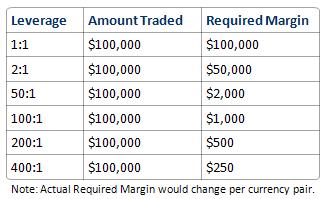

Leverage refers to the ratio between the margin deposited and the total trading volume. A higher leverage allows traders to control a larger position with a smaller deposit, but it also increases the risk exposure. For instance, a leverage ratio of 1:100 means that a trader can open a position worth $100,000 with a margin of $1,000.

Managing leverage effectively is essential. Excessive leverage can lead to margin calls when losses exceed the margin deposit. Margin calls force traders to deposit additional funds to maintain their positions, or they face the risk of liquidation.

Managing Margin and Free Margin

Skilled traders utilize various strategies to manage their margin and free margin prudently.

- Risk management: Setting stop-loss orders and maintaining a well-defined risk-reward ratio are vital.

- Monitoring account equity: Traders should continuously track their account equity to ensure it remains adequate to sustain potential losses.

- Managing open positions: Reducing the number of open positions during periods of high volatility.

- Hedging: Employing hedging techniques to reduce overall risk exposure.

Image: www.paradise-greece.com

Latest Trends and Developments

The forex market is constantly evolving, with advancements influencing margin and free margin practices.

- Increased competition: Intense competition among brokers is leading to the introduction of more favorable margin terms and conditions.

- Technology: Technological advancements, such as artificial intelligence and machine learning, are aiding in risk management and margin optimization.

- Regulatory changes: Regulatory bodies are continually updating guidelines regarding leverage and margin requirements.

Tips from the Experts

Seasoned forex traders share valuable insights for managing margin effectively:

- Trade within your means: Avoid excessive leverage that can lead to unsustainable losses.

- Understand margin requirements: Familiarize yourself with the margin policies of your broker to avoid surprises.

- Monitor free margin closely: Manage your free margin to ensure you do not breach margin requirements during market fluctuations.

- Avoid trading during high volatility: Market turmoil can erode free margin rapidly; exercise caution during such periods.

Margin And Free Margin In Forex

FAQs on Margin and Free Margin

Q: Can I lose more than my margin deposit?

A: Yes, leverage amplifies both profits and losses, so losses can exceed the margin deposit in some instances.

Q: What happens if my margin call is not met?

A: Failure to fulfill a margin call may result in liquidation of open positions and potential account closure.

Q: Is hedging an effective risk management strategy?

A: Yes, hedging involves opening offsetting positions to reduce overall risk exposure.

Q: What are the benefits of using a higher leverage ratio?

A: Higher leverage can magnify potential profits, but it also significantly amplifies risks.

Are you ready to dominate the forex markets by mastering margin and free margin? The insights and tips provided in this article will equip you with the knowledge and expertise to navigate the complexities of forex trading.