Unveiling the London Session: Unlocking Forex Trading Potential

Image: www.mql5.com

The foreign exchange (Forex) market, a global hub where currencies are traded, operates 24 hours a day, across different global financial centers. Among these, the London session stands out as a prominent period, offering traders unique advantages and insights. This comprehensive guide will delve into the intricacies of the London session, empowering you with valuable information to enhance your Forex trading endeavors.

Understanding the London Session

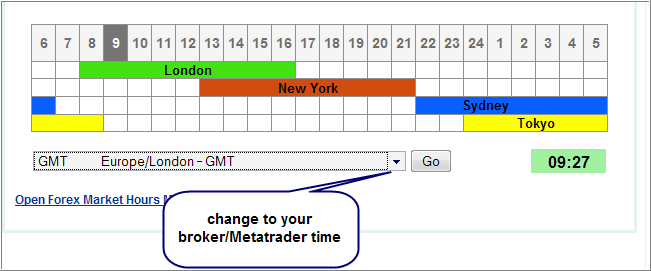

The London session, spanning from 8:00 AM to 4:00 PM GMT, finds its epicenter in the United Kingdom’s bustling financial district and serves as a catalyst for a surge in trading activity. During this period, the European Central Bank (ECB) and Bank of England (BOE) release vital economic indicators and interest rate decisions, shaping the market’s trajectory for the remainder of the trading day.

The London session is renowned for its high liquidity, the ease with which traders can buy and sell currencies, attributed to a confluence of factors. The presence of major banking institutions, investment firms, and central banks within Europe contributes significantly to this liquidity.

Advantages of Trading in the London Session

For those navigating the Forex market, the London session presents an array of advantages that can elevate their trading strategies.

-

Amplified Volatility and Trading Volume: The period between 8:00 AM and 12:00 PM GMT experiences heightened activity levels as European markets overlap with the opening of the United States session, resulting in increased price fluctuations and trading volume.

-

Access to Major Economic News and Events: The London session often coincides with announcements of economic indicators, interest rate decisions, and geopolitical events from the European Union, United Kingdom, and Switzerland. These occurrences can significantly impact currency pairs, presenting opportunities for informed trading.

-

Prestige and Stability: As the global financial hub, London commands a high level of prominence within the Forex market. The stability and transparency associated with the city’s regulatory frameworks foster a sense of confidence among traders.

Unveiling Expert Insights and Actionable Tips

To maximize your success in the London session, here are invaluable insights from seasoned traders:

-

Monitor Economic Events and News: Keep abreast of scheduled economic releases and news announcements that may influence market movements. Economic indicators, such as employment data and gross domestic product (GDP) figures, can have a substantial impact on currency pairs.

-

Analyze Charts and Technical Tools: Leverage technical analysis to identify patterns and trends in price charts. Utilize technical indicators like moving averages, support and resistance levels, and Fibonacci retracements to inform your trading decisions.

-

Manage Risk Effectively: Risk management is paramount in Forex trading. Employ stop-loss orders to limit potential losses, determine appropriate position sizes, and maintain a disciplined risk-to-reward ratio.

-

Patience and Discipline: The London session can be dynamic and unpredictable. Exercise patience, avoid impulsive trades, and adhere to a well-defined trading plan based on sound analysis.

Harnessing the London Session’s Potential

The London session, with its unique characteristics and advantages, offers traders the prospect for lucrative opportunities. By blending a comprehensive understanding of this session’s dynamics with expert insights, you can enhance your Forex trading prowess and realize greater success in the global currency market. As you continue your journey in Forex trading, stay informed, embrace patience and discipline, and harness the full potential of the London session.

:max_bytes(150000):strip_icc()/dotdash_Final_The_forex_3_session_system_Sep_2020-01-63dccf5cf6604249b6ce8c41311909fd.jpg)

Image: howtotradeonforex.github.io

London Session Forex Time Gmt