Exploring the Distinctions Between Forex Cards and Traditional Payment Methods

In the realm of international finance, forex cards have emerged as popular choices for travelers and frequent business travelers. These specialized payment cards offer a convenient and cost-effective way to access foreign currencies, but understanding their nature and functionality is crucial. A common question that arises is whether forex cards are debit cards or credit cards. This article delves into their characteristics and key differences to provide clarity on this subject.

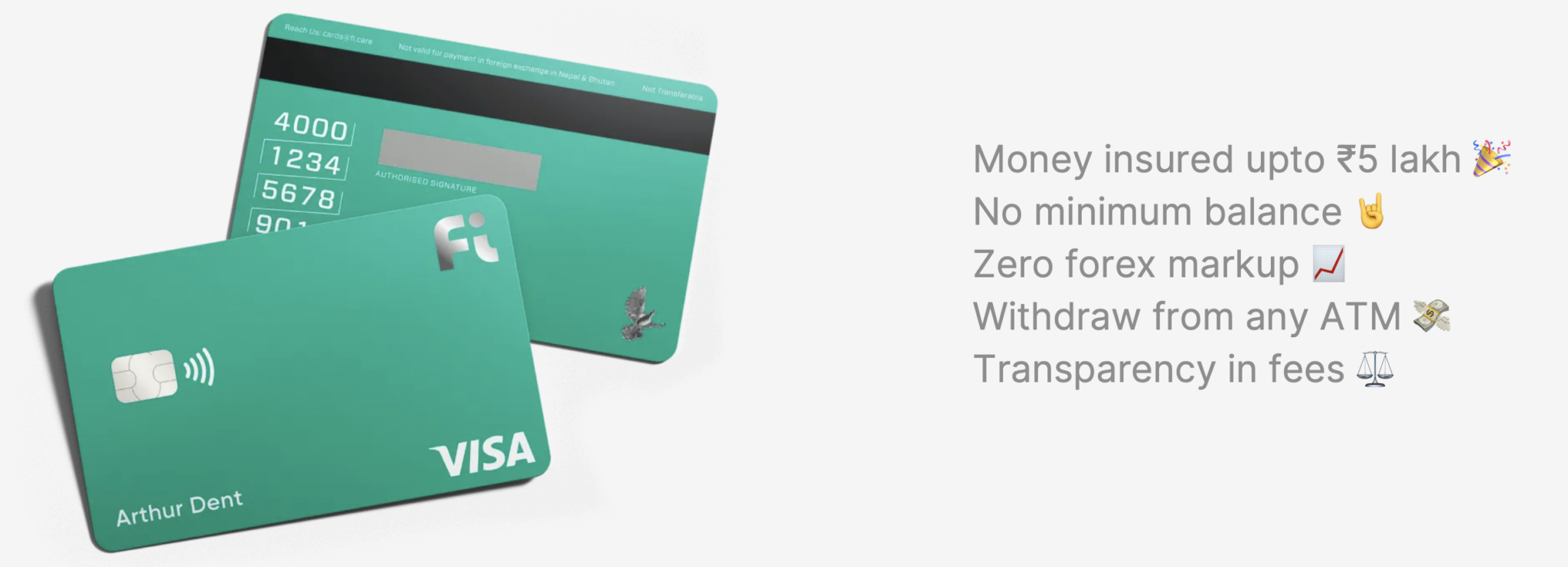

Image: forexmarketview.com

Understanding Prepaid Forex Cards

Unlike traditional credit cards, prepaid forex cards are not linked to a credit line or revolving balance. They function like debit cards, requiring you to load them with funds before use. When making a purchase or withdrawal, the amount is deducted directly from the available balance on the card. Prepaid forex cards offer several benefits, including:

- No interest charges or late payment fees

- Control over spending and budget management

- Widely accepted at ATMs and POS terminals

Forex Debit Cards vs. Credit Cards

Forex debit cards, like prepaid forex cards, are linked to a bank account. Funds for transactions are deducted directly from the account balance. They provide similar benefits as prepaid forex cards and are ideal for individuals who prefer to manage their expenses through direct debit. However, unlike credit cards, forex debit cards do not offer reward points or incentives.

Credit cards, on the other hand, are essentially a form of short-term financing. When using a credit card, funds are borrowed and must be repaid within a specified period. Credit cards often come with perks such as rewards points, travel benefits, and insurance coverage. However, they can carry high interest rates and fees if balances are not paid in full by the due date.

Tips and Expert Advice for Using Forex Cards

- Compare and choose a forex card that aligns with your travel needs and offers competitive exchange rates.

- Load the card with funds before your trip to avoid loading fees and poor exchange rates at ATMs abroad.

- Consider using a combination of forex cards and other payment options to manage costs and exchange rate risks.

- Monitor your card balance regularly to track expenses and prevent overspending.

Image: livefromalounge.com

Frequently Asked Questions

-

Q: Can I use a forex card in all countries?

A: Yes, forex cards are widely accepted in most countries, but it’s always advisable to check the card’s acceptance before your trip.

-

Q: Are there transaction fees for using a forex card?

A: Transaction fees vary depending on the card provider. Some cards may charge a small fee for withdrawals or currency conversions, while others offer fee-free transactions.

-

Q: How do I load a forex card?

A: You can load a forex card through online portals, mobile banking, or at participating banks. The loading methods and fees may vary depending on the card provider.

Is Forex Card Debit Or Credit

Conclusion

Forex cards are a valuable financial tool for international travel and business transactions, offering convenience, cost-effectiveness, and ease of use. Understanding their nature as either debit or credit cards is essential for making informed decisions. By choosing the right forex card and following expert advice, individuals can optimize their financial management and make the most of their overseas experiences.

Are you interested in learning more about forex cards and their applications? Share your questions and comments below, and we’ll be delighted to provide further insights.