Internal Techniques for Forex Risk Management: Safeguarding Your Profits in Turbulent Markets

Image: howtotrade.com

In the ever-evolving world of forex trading, where fluctuations can turn dreams into dust in an instant, mastering the art of risk management is not just an option but a necessity. As the adage goes, “If you fail to plan, you plan to fail.” This couldn’t be more true in the volatile realm of currency exchange.

Understanding and implementing effective internal risk management techniques can transform your trading journey from a rollercoaster ride of emotions to a calculated and profitable endeavor. In this all-encompassing guide, we will delve into the depths of internal risk management strategies, empowering you with the knowledge and tools to navigate the turbulent waters of the forex market with confidence.

Navigating Forex Risk: The Cornerstones of Internal Risk Management

The foundation of internal risk management lies in understanding the inherent risks associated with forex trading. These risks encompass market volatility, liquidity risk, cyber threats, and, perhaps most importantly, psychological traps. Once you have a clear grasp of the potential hazards, you can begin to fortify your trading strategy with the following internal risk management techniques:

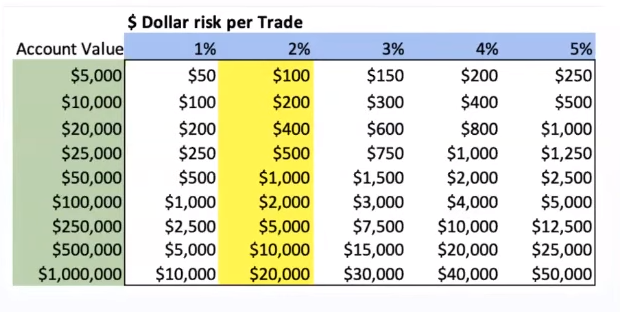

1. Position Sizing: The Holy Grail of Risk Management

Position sizing is the bedrock of forex risk management. It dictates the size of your trades in relation to your account balance and risk tolerance. By meticulously calculating the appropriate lot size based on a predefined risk-to-reward ratio, you can limit your potential losses and preserve your hard-earned capital.

2. Stop-Loss Orders: Your Shield Against Market Turmoil

Stop-loss orders are your safety net, automatically closing your trades when the market price reaches a predetermined level. They act as a failsafe, preventing catastrophic losses during sudden market reversals. Setting realistic stop-loss levels based on technical analysis and risk tolerance is crucial to protect your profits.

3. Take-Profit Orders: Locking in Your Gains

As the adage goes, “Take profits when the taking’s good.” Take-profit orders secure your earnings by closing your trades when the currency pair reaches your desired profit target. They prevent greed from clouding your judgment and ensure you maximize your profits while the market is in your favor.

4. Hedging: A Balancing Act in Volatility

Hedging involves opening multiple positions in opposite directions to offset the risk of one or both trades going against you. It is an advanced risk management technique that requires a deep understanding of market dynamics and can significantly reduce your overall risk exposure. However, it is essential to proceed with caution as hedging can also limit your potential profits.

5. Risk-to-Reward Ratio: The Compass of Prudent Trading

Every risk-averse trader should navigate by the guiding star of the risk-to-reward ratio. It compares the potential profit to the potential loss for each trade. A favorable ratio indicates a higher likelihood of a profitable outcome, helping you identify smart trading opportunities with minimal downside risk.

6. Drawdown Management: Mitigating Emotional Traps

Drawdowns are an inevitable part of trading. They test your patience, discipline, and emotional resilience. Effective drawdown management involves acknowledging and accepting your risk limits. Instead of panicking and abandoning your strategy, focus on maintaining composure and sticking to your predefined trading plan.

7. Technical Analysis: Unveiling Market Trends

Technical analysis is a valuable risk management tool, providing insights into market trends and helping you identify potential trading opportunities. By analyzing historical price data, you can anticipate market movements and make informed trading decisions that minimize risk and maximize profit potential.

8. Risk Tolerance: Knowing Your Limits

Understanding your risk tolerance is fundamental to successful forex trading. It defines how much risk you are willing to take in pursuit of profits. A realistic assessment of your risk appetite will help you avoid excessive leverage and protect your financial well-being.

Conclusion: Embracing Risk Management’s Transformative Power

Risk management in forex trading is not merely about protecting your capital but about paving the path to consistent profitability. By mastering the internal techniques outlined in this guide, you can transform your trading journey from a perilous adventure to a calculated and rewarding endeavor. Remember, risk management is not just a technique; it’s a mindset that will empower you to trade with confidence, navigate market volatility, and safeguard your financial future.

Image: www.lesoptionscacompte.ca

Internal Techniques For Forex Risk Management