Introduction

In the realm of financial markets, where currencies and digital assets dance to the rhythm of global economics, the realm of Forex and Crypto trading has emerged as a beacon of opportunity for savvy investors. Forex, the dynamic world of currency exchange, and Crypto, the enigmatic sphere of digital coin commerce, beckon with the allure of profit and the thrill of market mastery. In this comprehensive guide, we will embark on an educational journey, unraveling the intricacies of these enthralling markets and empowering you to seize the rewards that await.

Image: homecare24.id

Delving into Forex: The Global Currency Marketplace

Foreign exchange, or Forex for short, is the largest and most liquid financial market in the world, where currencies are traded in pairs. In this ever-evolving exchange, investors capitalize on fluctuating currency values, seeking to profit from the differences in exchange rates. The market operates 24 hours a day, 5 days a week, connecting major financial centers worldwide, providing traders with unparalleled accessibility and limitless opportunities.

Exploring Crypto: The Enigmatic Digital Currency Realm

Cryptocurrency, often referred to as Crypto, encompasses a new breed of digital assets that have taken the financial world by storm. These decentralized, blockchain-based currencies, such as Bitcoin and Ethereum, operate independently of central banks, offering investors a potentially lucrative alternative to traditional fiat currencies. The rapid evolution of Crypto and its decentralized nature have created a dynamic and ever-changing market filled with both immense potential and inherent risks.

Understanding the Mechanics of Trading

Whether it’s trading Forex or Crypto, the underlying mechanics remain the same. Traders carefully analyze market trends, news events, and economic indicators to forecast the future direction of currency or asset prices. Based on their predictions, they place orders to buy or sell at a specific price, hoping to capitalize on fluctuations in the market. The key to success lies in developing a sound understanding of market behavior, managing risk effectively, and executing trades with precision.

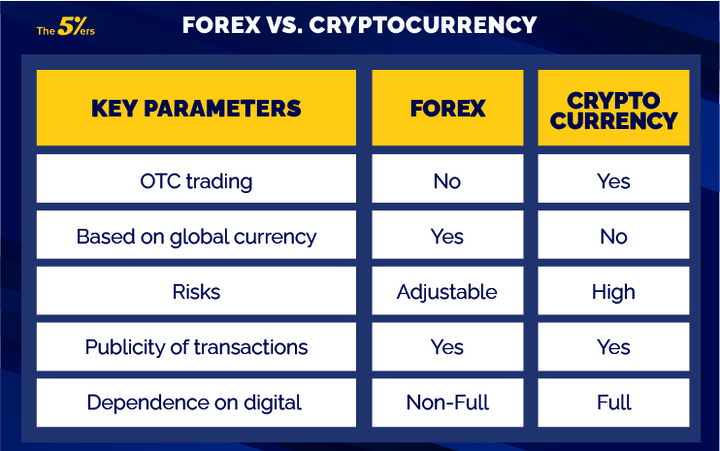

Image: the5ers.com

The Power of Leverage: Amplifying Profits and Risks

One of the unique features of Forex and Crypto trading is the ability to use leverage. This financial tool allows traders to amplify their potential profits by borrowing capital from their brokerage firm. While leverage can magnify potential gains, it also has the potential to magnify losses. It is crucial for traders to understand the risks associated with leverage and employ it wisely, ensuring that their trades align with their risk appetite and trading strategy.

Harnessing Technical and Fundamental Analysis

To navigate the turbulent waters of Forex and Crypto trading successfully, traders rely on two primary analytical techniques: technical analysis and fundamental analysis. Technical analysis involves studying historical price data and patterns to identify potential trading opportunities. Fundamental analysis, on the other hand, examines economic factors such as interest rates, GDP data, and political developments to assess the intrinsic value of an asset. By combining both approaches, traders can gain a comprehensive understanding of market dynamics and make informed trading decisions.

Mastering Risk Management: The Key to Trading Success

In the high-stakes world of Forex and Crypto trading, managing risk is paramount. The market’s volatility can be both a source of opportunity and a breeding ground for losses. Traders must implement robust risk management strategies, such as defining their risk tolerance, setting stop-loss orders to limit potential losses, and maintaining proper leverage levels. By taking a disciplined approach to risk management, traders can mitigate the inherent risks and increase their chances of long-term success.

Embracing Education: The Path to Trading Proficiency

Becoming a successful Forex and Crypto trader requires a commitment to continuous learning and education. The markets are constantly evolving, and traders must stay abreast of the latest trends, strategies, and technological advancements. Reading books, attending webinars, and engaging in online courses are excellent ways to deepen one’s knowledge and enhance trading skills.

How To Trade Forex And Crypto

Conclusion

The world of Forex and Crypto trading, with its immense potential and inherent risks, invites those who dare to embark on a remarkable journey. By understanding the markets, mastering the trading mechanics, embracing risk management, and pursuing continual education, you can unlock the doors to financial success. Remember, trading these markets requires a discerning mind, a disciplined approach, and an unwavering dedication to personal growth. As you navigate the ever-changing landscapes of Forex and Crypto, let this guide serve as your trusted compass, leading you towards financial empowerment.