Are you ready to unlock the secrets of successful forex trading? Look no further than the power of forex analysis software. In today’s ever-changing financial landscape, having access to the right tools can make all the difference. Forex analysis software is your secret weapon to understanding market trends, identifying trading opportunities, and maximizing your profits. Join us as we embark on an in-depth exploration of this indispensable tool, providing you with a comprehensive guide to mastering the art of forex trading.

Image: howtotradeonforex.github.io

Forex Analysis Software: Dive into the intricate world of forex trading with the aid of powerful software designed to empower traders of all skill levels. Get ready to analyze market data, predict future price movements, and execute trades with precision. Whether you’re just starting your trading journey or you’re a seasoned pro looking to enhance your strategies, forex analysis software has something to offer you.

Unveiling the Anatomy of Forex Analysis Software

Understanding the inner workings of forex analysis software is essential for effective utilization. Let’s delve into its key components:

1. Market Data and Analysis

Forex analysis software acts as a window into the vast world of market data. It provides real-time quotes, historical price charts, and various technical indicators. This comprehensive data empowers you to identify market trends, discover patterns, and make informed trading decisions.

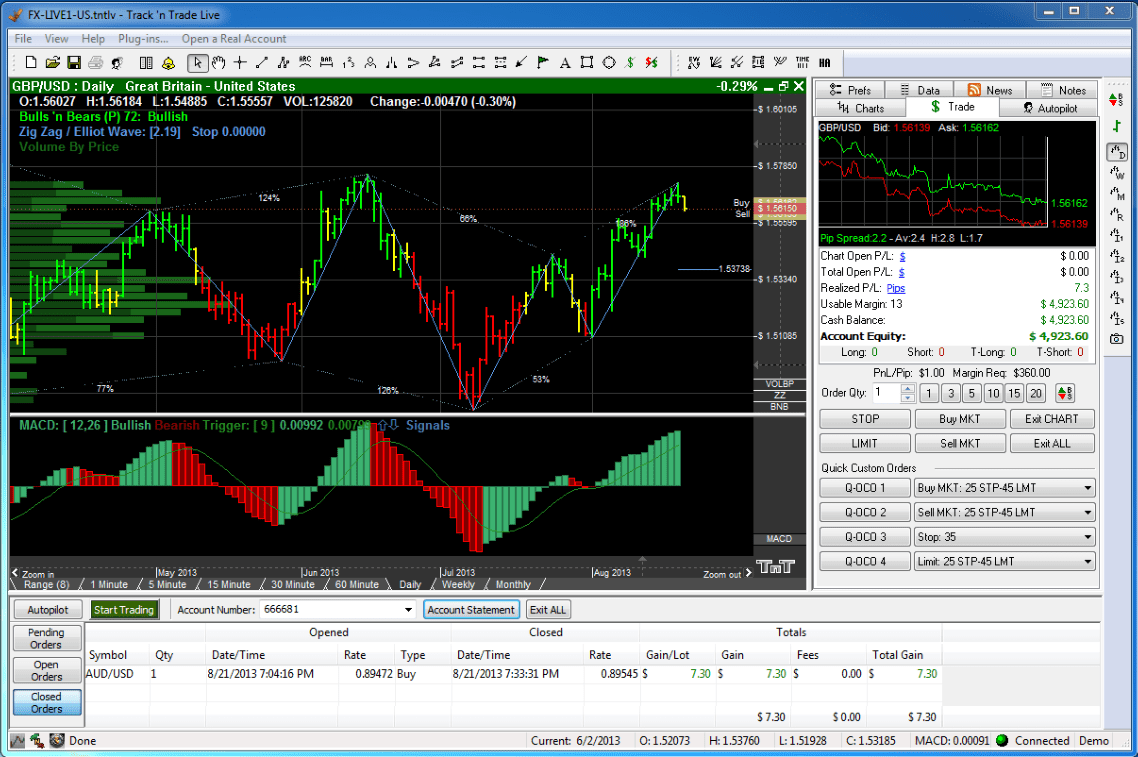

2. Charting and Visualization

Visualizing market data is crucial for understanding complex price movements. Forex analysis software offers advanced charting capabilities, allowing you to create customizable charts and apply technical analysis tools. The visual representation of data enhances your ability to spot trading opportunities and make accurate predictions.

Image: www.geckosoftware.com

3. Backtesting and Simulation

Practice makes perfect in the world of forex trading. Forex analysis software provides invaluable backtesting and simulation features. Test your trading strategies against historical data to identify strengths, weaknesses, and potential pitfalls. Risk-free simulations empower you to refine your approach before risking real capital.

4. Trade Execution and Management

Seamless trade execution is at your fingertips with forex analysis software. Integrate your trading account to execute trades directly from the platform. Manage open positions, set stop-loss orders, and take profit levels – all within a single interface. This streamlined approach saves time and enhances trading efficiency.

Empowering Traders: The Benefits of Forex Analysis Software

Embracing forex analysis software unlocks a world of benefits that empower traders:

1. Enhanced Analysis and Forecasting

Equipped with real-time data, charting tools, and technical indicators, forex analysis software elevates your analysis capabilities. Identify trading opportunities with greater precision, anticipate market movements, and make informed decisions based on a comprehensive understanding of market dynamics.

2. Risk Minimization and Management

Manage risk with confidence using backtesting, simulation, and trade management tools. Test your strategies, identify potential risks, and refine your approach before executing trades. Proactively mitigate losses and maximize profits with the help of advanced risk management features.

3. Automation and Efficiency

Streamline your trading routine with the automation capabilities of forex analysis software. Set up trading alerts, automate trade execution, and monitor market movements in real-time. Free up valuable time and focus on making strategic decisions that drive your trading performance.

A Journey Through the Forex Software Landscape

Navigating the diverse world of forex analysis software can be daunting. Let’s explore some of the leading options to find the perfect fit for your trading style:

1. MetaTrader 4 and MetaTrader 5

MetaQuotes Software’s MetaTrader 4 and MetaTrader 5 are industry-leading platforms renowned for their user-friendly interface, advanced charting capabilities, and vast array of technical indicators. Trusted by traders worldwide, these platforms offer robust features and a thriving community for knowledge sharing.

2. TradingView

TradingView is an innovative web-based platform that combines powerful charting tools, social trading features, and a comprehensive library of technical indicators. Its intuitive interface and customizable workspace cater to both beginners and experienced traders.

3. Sierra Chart

Traders seeking professional-grade software will find a formidable ally in Sierra Chart. Boasting advanced charting capabilities, sophisticated order entry tools, and real-time market data, Sierra Chart empowers traders with the tools they need to excel in the demanding world of forex trading.

Harnessing the Potential: Tips for Using Forex Analysis Software Effectively

Unleashing the full potential of forex analysis software requires a strategic approach:

1. Define Your Trading Strategy

Before selecting software, clearly define your trading strategy. Determine your trading style, timeframe, and risk tolerance. This will guide your choice of software and ensure it aligns with your trading objectives.

2. Explore and Trial Software

Don’t settle for the first software you encounter. Take advantage of free trials or demo accounts to thoroughly evaluate different platforms. Test their features, functionality, and user interface to find the one that resonates with your needs.

3. Understand Technical Analysis

Forex analysis software is a powerful tool, but it’s essential to possess a solid understanding of technical analysis principles. Educate yourself on chart patterns, indicators, and trading strategies. This knowledge will empower you to interpret market data effectively.

4. Practice and Refine

Mastery of forex analysis software requires practice and patience. Spend time exploring its features, practicing your analysis skills, and refining your trading strategies. Backtesting and simulation provide risk-free environments to test your approach and continuously improve.

Forex Analysis Software Free Download

Conclusion: Embracing Forex Analysis Software for Trading Success

Forex analysis software is an indispensable tool for traders seeking success in the fast-paced world of forex trading. It empowers traders with the ability to analyze market data, identify trading opportunities, and manage risk. By choosing the right software, mastering technical analysis principles, and continuously practicing, traders can unlock the full potential of forex analysis software and elevate their trading performance. Embrace this powerful tool, embark on a journey of learning and improvement, and unlock the door to consistent profitability in the world of forex trading.